How to register a sole trader business in NZ

Starting your own business is an exciting venture. For a lot of people in New Zealand who want to start their own business, the sole trader model is the best way to do it. It’s easy to use, gives you full control, and has fewer rules to follow than a limited company. But how do you start? The first important step toward becoming self-employed in New Zealand is to learn how to register as a sole trader.

This guide will help you with everything, from learning what a sole trader is to keeping track of your taxes and legal duties. We’ll go over everything you need to do to start your business with confidence, like getting your New Zealand Business Number (NZBN) and signing up with the Inland Revenue Department (IRD). This is your guide to getting started on the right foot, whether you’re a freelancer, a contractor, or turning a side job into a full-time job.

What does it mean to be a sole trader in New Zealand?

Before we get into the registration process, let’s make sure we know what it means to be a sole trader. You are the business when you are a sole trader. There is no legal difference between you and your business. You get to make all the decisions and keep all the money after taxes.

But this also means that you are responsible for all of the business’s debts and obligations. This is called having unlimited liability. This important difference is often what makes people choose between a sole trader and a company structure in New Zealand. A company protects your personal assets by limiting your liability, but it also has more complicated reporting and administrative requirements. For a lot of new businesses, the sole trader model is the easiest and most practical option.

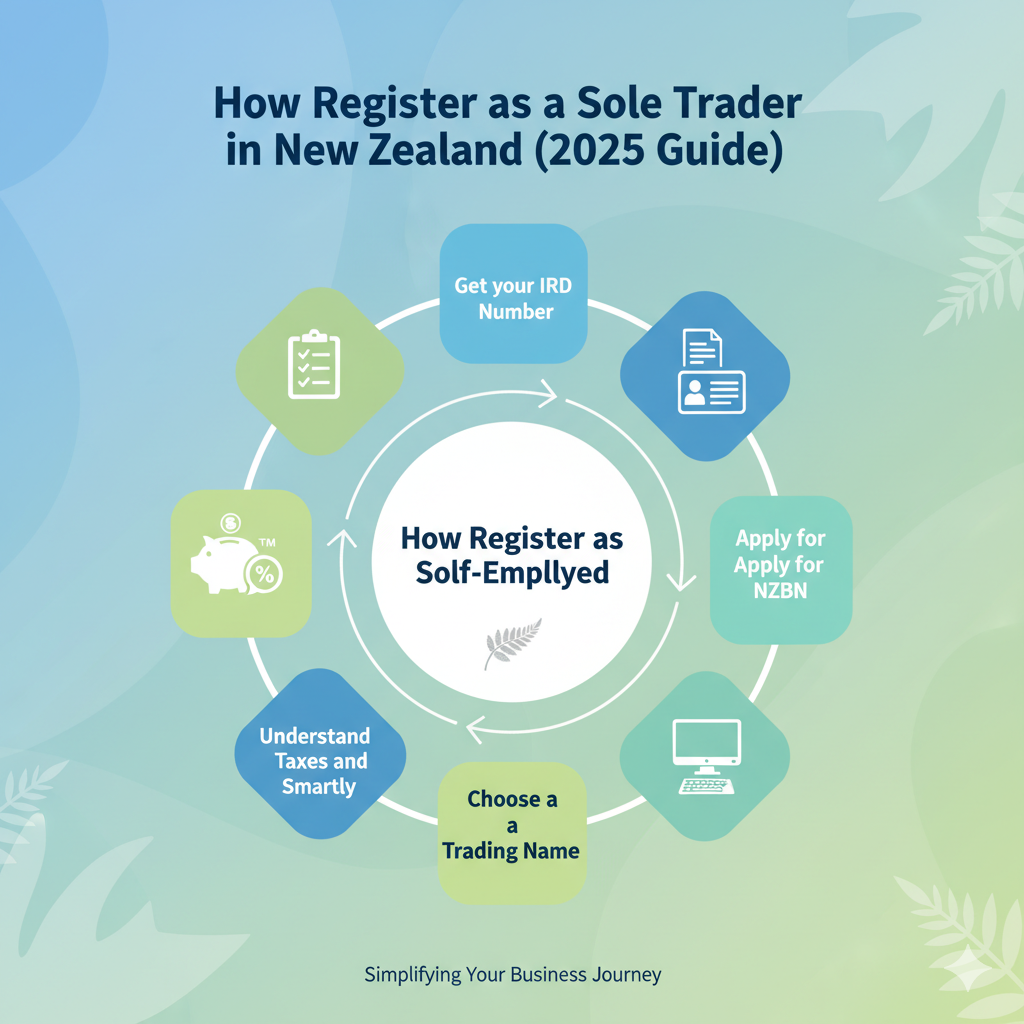

Step by step: How to Sign Up as a Sole Trader in New Zealand Online

Are sole traders required to register in New Zealand? is one of the most common questions. The short answer is yes, for tax reasons. You don’t have to sign up for a central “sole trader register” like you would for a business, but you do have to sign up with the Inland Revenue Department (IRD). This is how to do it.

Step 1: Get your own IRD number.

You probably already have a personal IRD number if you’ve ever worked in New Zealand. This is very important for anything having to do with taxes. You can apply for one on the IRD website if you don’t already have one. You will need to show proof of identity, like a driver’s license or passport.

Step 2: Sign up with the IRD as a self-employed person

This is the most important step. You need to tell the IRD that you are making money as a self-employed person. You can do this through your myIR account online.

- Sign in to myIR: Access your personal myIR account on the IRD website.

- Add a new company: Find an option to sign up for a new business or add income from being self-employed.

- Give your information: You will need to tell them what your business does, when you started trading, and how much money you expect to make in your first year.

- If you need to, sign up for GST: You will be asked to register for Goods and Services Tax (GST) during this process. You only need to register for GST if you expect to make more than NZ$60,000 in sales in a year.It is possible to register voluntarily if your turnover is below this level. This lets you get back GST on your business expenses.

Step 3: Get a business number in New Zealand (NZBN)

Getting a NZBN is highly recommended, even though it’s not always required for sole traders. An NZBN is a special code that makes it easier to work with other businesses and government agencies. It helps suppliers and customers verify that you are a legitimate business.

You can apply for a NZBN as a sole trader online for free. It doesn’t take long, and all you need is your IRD number and proof of who you are. Having a NZBN can make it easier to send invoices, apply for business loans, and do other business-to-business (B2B) things.

Step 4: Pick a name for your trading business

As a sole trader, you can trade under your own name or choose a specific business name. A “trading name” is a name that is not your own. A trading name for a sole trader doesn’t give them legal protection like a registered company does. Someone else could have the same name.

It’s a good idea to:

- Check to see if it’s available: Use a tool like OneCheck to find out if the name is already being used as a trademark, a business name, or a web domain.

- Don’t infringe: Ensure your chosen name doesn’t infringe on an existing trademark to avoid legal issues down the line.

Knowing what your legal and tax duties are

You need to know what your ongoing responsibilities are after you register. In addition to offering a service or selling a product, running a business also means following the rules.

Tax on Income

If you’re a sole trader, you only pay income tax on the money your business makes, not on all of its sales. Your profit is the money you make after paying all of your business expenses. You pay taxes on this net profit plus any other income you have, like from a part-time job. At the end of the financial year, you will file an Individual Income Tax Return (IR3).

Tax for the time being

You will probably have to pay provisional tax in your second year if you owe more than $5,000 in taxes at the end of your first year. With provisional tax, you can pay your income tax in smaller amounts throughout the year instead of all at once. This helps keep cash flow steady, but it can be a shock if you’re not ready for it. If you need to start paying provisional tax, the IRD will let you know.

What you need to do for GST

If you are registered for GST, you must:

- Charge GST (currently 15%) on all of your goods and services.

- Send the IRD regular GST returns every month, two months, or six months.

- Pay the GST you’ve collected, but not the GST you’ve paid on business costs.

ACC Levies

If you work for yourself, you have to pay your own ACC levies. These taxes protect you from getting hurt. After you file your first tax return as a sole trader, ACC will send you a bill. The amount is based on how much money you make as a self-employed person and what kind of work you do.

Managing Your Finances and Business Operations

A successful sole trader business depends on good financial management.

Don’t mix your business and personal money.

Even though you and your business are the same person in the eyes of the law, you need to open a separate bank account for your business. This one simple step makes it much easier to keep track of your income and expenses, makes tax time easier, and gives you a better idea of how your business is doing financially.

Keep track of your income and expenses Very carefully

Keep track of all the money that comes in and goes out in great detail. You can use accounting software, a spreadsheet, or a notebook just for this. This is not only a good idea, it’s also the law. You need records to figure out how much money you made and to back up your expense claims to the IRD if they ever ask.

Claimable expenses include:

- costs related to a vehicle (if it is used for business).

- Costs of a home office include some of your rent, mortgage interest, power, and internet.

- Office supplies and stationery.

- Bills for the phone and the internet.

- Fees for accounting and legal work.

Things You Shouldn’t Do When You’re Just Starting Out

A lot of new sole traders make the same mistakes. Knowing about them can save you a lot of time, money, and stress.

- Not putting money aside for taxes: This is the most common pitfall. When you make money, taxes aren’t automatically taken out like they are for employees. You need to set aside some of every payment you get for your taxes. In general, it’s a good idea to put 20–30% of your money in a separate savings account.

- Forgetting about ACC levies: A lot of people are shocked by their first ACC bill. From day one, you should include this in your financial plans.

- Putting personal and business money together: If you use one bank account for everything, keeping track of your money will be a nightmare. It makes it almost impossible to tell how well your business is really doing.

- Not signing up for GST when you need to: If you don’t register for GST after making more than $60,000, you could have to pay fines and backdated payments. As you get closer to this number, keep a close eye on your income.

Are you ready to start your own business as a sole trader?

Starting your own business as a sole trader in New Zealand is easy and gives you a lot of power. You can set yourself up for success by registering online, knowing what taxes you have to pay, and being smart with your money. It’s very rewarding to be your own boss because you have freedom and control. If you prepare properly, you can handle the challenges with confidence.

While the process is straightforward, it can still feel overwhelming. Making sure you’ve checked everything off and set up your systems correctly from the start gives you a lot of peace of mind.

![How to Start an Ecommerce Business in NZ [2025 Guide]](https://businesskiwi.com/wp-content/uploads/2025/11/How-to-Start-an-Ecommerce-Business-in-NZ-644-300x200.png)