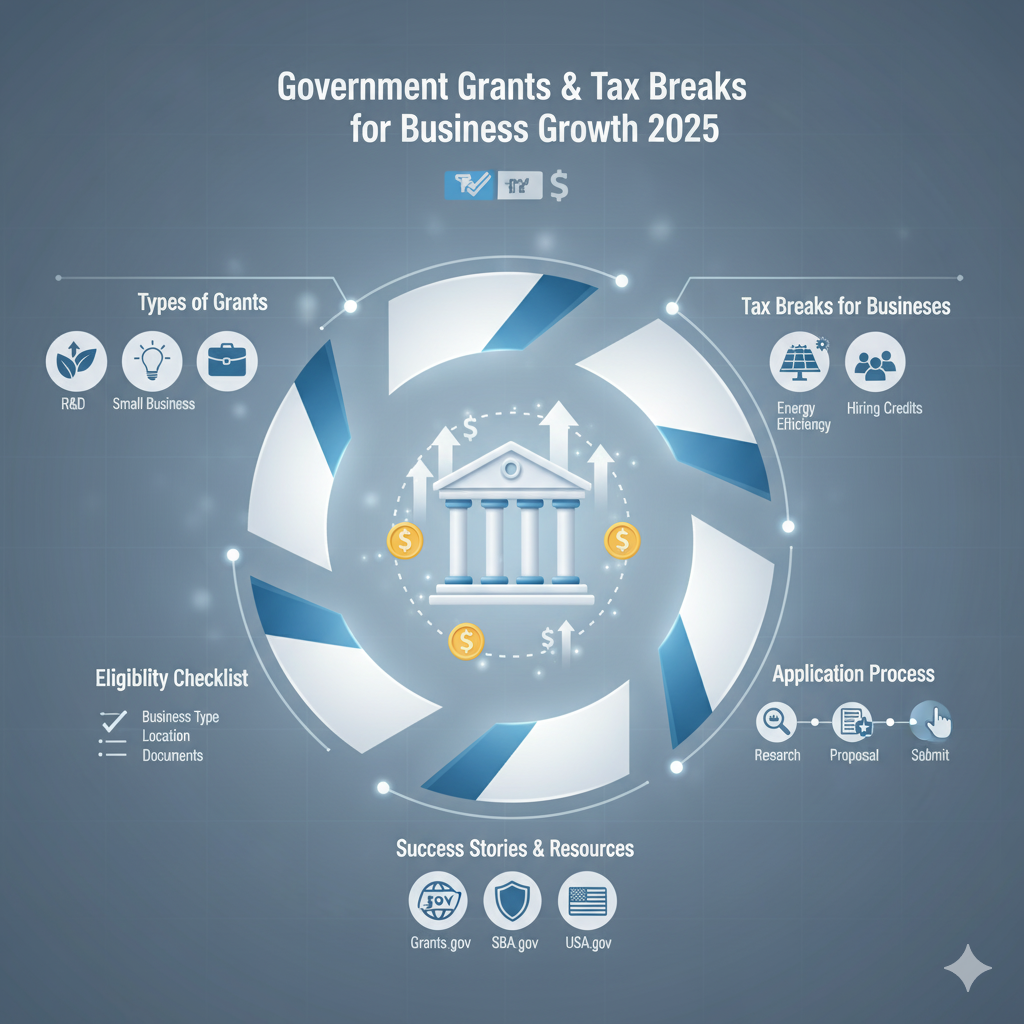

A guide to Government grants and tax incentives for businesses

You need money to start or grow a business. Loans and investors are common ways to get money, but many business owners don’t think about a powerful alternative: government grants and tax breaks. This money can give your business the boost it needs to grow, innovate, and do well without having to pay it back or give up equity.

It can be hard to understand and get around in the world of government funding. The application processes can be long and hard, and there is often a lot of competition. But the benefits, like funding research and development and hiring new people, make the work worth it. This guide will make the process easier to understand by giving you a clear path to follow to find and get the money your business needs. We will talk about the different kinds of grants, the most important tax breaks, and give you useful tips on how to apply successfully.

What is a grant from the government?

Before we get started, let’s make sure we know what a government grant is. A government grant is a sum of money given to a business or person by a federal, state, or local government agency for a specific purpose that fits with the goals of public policy. You don’t have to pay back a grant like you do a loan. These are very popular because they are like free money that can help you reach certain business goals, like making new technology, creating jobs, or using more environmentally friendly methods.

Different kinds of government grants for businesses

The government usually gives businesses grants to boost the economy, encourage new ideas, and help social or environmental goals. There are many different types of funding available, so it’s important to figure out which one is best for your business.

Research and Development (R&D) Grants

The goal of R&D grants is to encourage new ideas and technological progress. You might be able to get this if your business is working on a new product, service, or process that is new in terms of science or technology. These grants are very hard to get, and you usually have to show that your project is possible and have a detailed plan for it.

The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs are two of the biggest sources of early-stage R&D funding in the U.S. They encourage small businesses to do federal research and development that could lead to commercial use.

Grants for Small Businesses

These are some of the most common kinds of grants that people can get. Government agencies at all levels give grants to small businesses to help them grow because they know that small businesses are the backbone of the economy. You can use these funds for many things, such as buying equipment, marketing, hiring staff, or growing your business.

The U.S. Small Business Administration (SBA) is a major source of information. It offers a number of grant programs, many of which are run in partnership with other groups. For instance, businesses owned by women, veterans, or minorities, or those in areas with low incomes may be able to get grants. The best way to find the most up-to-date small business grants in 2025 is to look on official government websites.

Grants for the environment or “green” things

Sustainability is becoming a global priority, and governments are encouraging businesses to be more environmentally friendly. Grants for the environment help pay for projects that cut down on pollution, save energy, create renewable resources, or encourage long-term growth. The Environmental Protection Agency (EPA) and the Department of Energy (DOE) are two important places to get these grants. These grants can help your business a lot if it is using green technology or making products that are good for the environment.

Unlocking Important Tax Breaks

Tax breaks are another great way to lower your costs and free up money for growth, in addition to direct funding. You can lower your taxable income by taking deductions or credits for certain business activities thanks to these incentives.

Tax Credits for R&D

The Research and Development (R&D) tax credit is one of the best incentives you can get. It is meant to encourage businesses to invest in new ideas. If your company is developing new products, improving existing ones, or creating new processes, a portion of the associated costs—including employee wages, supplies, and contract research expenses—may be eligible for a tax credit. Many businesses, especially small to medium-sized ones, are unaware they qualify, leaving significant money on the table.

Incentives for Energy Efficiency

Like green grants, tax breaks for energy efficiency give businesses money for using environmentally friendly methods. This can include installing solar panels, upgrading to energy-efficient HVAC systems, or purchasing electric vehicles for your company fleet. These incentives not only lower your taxes, but they also lower your long-term operating costs by lowering your energy use.

Credits for hiring

Businesses that hire people from certain target groups, like veterans, ex-felons, or people from areas with high unemployment rates, can get tax credits from the government. The Work Opportunity Tax Credit (WOTC) is a federal program that gives businesses a big tax break for each qualified employee they hire. This incentive helps businesses hire more people and helps the communities where they work. It’s a win-win situation that lowers your payroll tax bill and helps society.

Are You Eligible for Grants and Bonuses?

The requirements for getting a grant or incentive can be very different from one to the next. But most programs have some basic requirements in common.

General Requirements for Grants

- Structure of the Business: Most grants are open to businesses that make money, but some are only for non-profits. Your business must be legally registered and in good standing.

- Industry and Purpose: The grant’s purpose must align with your project. For example, an R&D grant won’t pay for a marketing campaign.

- Location: Some grants are only available to businesses in a certain city, state, or economic zone.

- Business Size: The SBIR and STTR programs, for example, are only for small businesses that meet the SBA’s size requirements.

Who Can Get Tax Breaks in General

- Qualifying Activities: Your business must be doing the things that the incentive is meant to encourage, such as doing research and development or hiring from target groups.

- Documentation: You need to keep very detailed records to back up your claims. This includes project plans, test results, and payroll records for the employees who worked on the project for the R&D tax credit.

- Tax Compliance: Your business must be up to date on its tax payments.

A Guide to How to Apply Step by Step

To find and apply for government grants and tax breaks for businesses, you need to follow a set process. To give yourself the best chance of success, do these things.

Step 1: Look into and find chances

Finding programs that work for your business is the first step. Official government websites are the best places to look for free government grants and tax breaks for businesses.

- Grants.gov is the main place to find all federal grants. You can look for things by keyword, category, or agency.

- SBA.gov: The Small Business Administration has information on loans, grants, and other resources for small business owners.

- Websites for State and Local Governments: Make sure to look at the websites of your state’s economic development agency and your local government to find opportunities in your area.

Step 2: Read the Guidelines Carefully

Read the application instructions carefully once you find a grant that looks good. Be sure to read the eligibility requirements, deadlines, and the exact information that is asked for. Not including one detail can get you disqualified. Now is not the time to skim.

Step 3: Write a strong proposal

Your grant proposal is your sales pitch. It needs to be clear, interesting, and convincing.

- Summary for Executives: Begin with a brief summary of your project and an explanation of why it needs money.

- Problem Statement: Clearly define the problem your project aims to solve.

- What the project is about: Detail your project plan, including goals, methodology, timeline, and expected outcomes.

- Money: Give a clear and reasonable budget that shows exactly how the grant money will be spent.

- Company Background: Give a short description of your business, the skills of your team, and any past successes.

Step 4: Get the papers you need

Most applications need a lot of extra papers, like:

- Plan for the business

- Profit and loss statements and balance sheets

- Tax forms

- Resumes of important staff members

- Letters of support from customers or partners

Step 5: Send it in and check back in

To avoid any last-minute technical problems, send in your application well before the deadline. Some agencies may let you check the status of your application online after you send it in. Don’t give up if your proposal is turned down. If you can, ask for feedback to make your next application stronger.

Examples of Success in the Real World

To illustrate the impact of these programs, let’s look at a couple of hypothetical case studies based on real-world scenarios.

Case Study 1: The R&D Tax Credit and a Tech Startup

A small software company was working on a new AI-based platform. They were unaware that their daily activities—including coding, testing, and prototyping—qualified for the R&D tax credit. After consulting with a tax expert, they documented their R&D expenses and claimed the credit. They saved more than $50,000 in taxes, which they used to hire another developer to speed up the launch of their product.

Case Study 2: A Green Grant for a Manufacturing Company

A medium-sized manufacturing company wanted to cut down on its high energy bills and carbon footprint. They asked the state for money to help pay for the installation of a solar panel system on the roof of their factory. Their proposal highlighted the projected energy savings and reduction in greenhouse gas emissions. They got a grant of $100,000, which paid for almost 40% of the project’s costs. The investment not only helped the environment, but it also cut their energy costs by 30% each year.

Important Tools for Your Search

It can be hard to figure out how to use government help programs, but these resources can help you get started:

- Grants.gov is the official website for all federal grant opportunities.

- SBA.gov: Gives advice on loans, grants, and business counseling.

- USA.gov: Gives businesses information about a lot of government benefits and services.

- Your state’s economic development website is a great place to find state-specific grants and incentives.

- Local Chamber of Commerce: They often have information about ways to get money in your area.

Move Forward with Your Business

Grants and tax breaks from the government are important sources of money that can help businesses grow, come up with new ideas, and give them a big edge over their competitors. The process takes a lot of work and attention to detail, but the possible return on your time and effort is huge. By understanding what government incentives are offered to businesses and how to access them, you can unlock new possibilities for your company’s future.

Do you feel like there are too many choices or don’t know where to start? You don’t have to go through this complicated situation on your own. Business Kiwi helps businesses like yours find and get the money they need to be successful. Our team of experts can help you with every part of the process, from doing research and writing proposals to making sure you follow all the rules.

Call us today to set up a meeting to talk about how we can help you get the most out of government grants and tax breaks for your business.

![How to Start an Ecommerce Business in NZ [2025 Guide]](https://businesskiwi.com/wp-content/uploads/2025/11/How-to-Start-an-Ecommerce-Business-in-NZ-644-300x200.png)