NZ Business Continuity Plan

A Business Continuity Plan (BCP) in New Zealand is a practical operating document that defines how a business will continue its most critical activities during disruption and how it will recover afterward. For NZ businesses, continuity planning must reflect local risks such as natural disasters, geographic isolation, limited supplier redundancy, and small-team dependency. This page explains business continuity planning specifically for the New Zealand context, with clear tables, examples, and actionable planning steps.

What a Business Continuity Plan Covers in New Zealand

A business continuity plan focuses on continuing essential operations, not protecting every part of the business equally. In New Zealand, an effective BCP usually covers the following areas:

- Critical business activities that must continue or restart quickly

- Staff availability and role coverage in small teams

- Access to systems, data, and financial accounts

- Alternative operating arrangements if premises are unavailable

- Communication responsibilities during disruption

The aim is operational survival and fast recovery, not theoretical risk elimination.

Why Business Continuity Planning Is Critical for NZ Businesses

New Zealand businesses face risk patterns that differ from larger or more connected markets. Disruption often has a greater impact because alternatives are limited.

Key NZ-specific continuity drivers include:

- Exposure to earthquakes, floods, storms, and volcanic events

- Dependence on a small number of suppliers or logistics routes

- Limited ability to rapidly replace staff in specialised roles

- Reliance on offshore shipping and ports

- Smaller cash buffers in many SMEs

A continuity plan reduces downtime, protects cash flow, and preserves customer confidence when these risks materialise.

Common Business Continuity Risks in New Zealand

The table below highlights typical continuity risks faced by NZ businesses and why they matter.

| Risk Type | NZ Context | Potential Impact |

|---|---|---|

| Natural disasters | Earthquakes, flooding, severe weather | Premises loss, staff unavailability |

| Supply chain disruption | Port delays, overseas suppliers | Stock shortages, missed deliveries |

| Power and telecom outages | Regional infrastructure limits | Inability to trade or communicate |

| Cyber or IT failure | Cloud systems, ransomware | Loss of access to data and systems |

| Key staff unavailability | Small teams, specialist roles | Operations halt |

Effective continuity planning prioritises the risks most likely to stop core operations.

Identifying Critical Business Functions

Not all functions require the same level of protection. NZ businesses should identify critical functions that must continue or resume first.

Typical critical functions include:

- Access to banking and cash flow

- Ability to invoice and collect payments

- Customer and supplier communication

- Delivery of core products or services

- Payroll and tax obligations

If a function cannot stop without causing serious financial or legal consequences, it should be prioritised in the BCP.

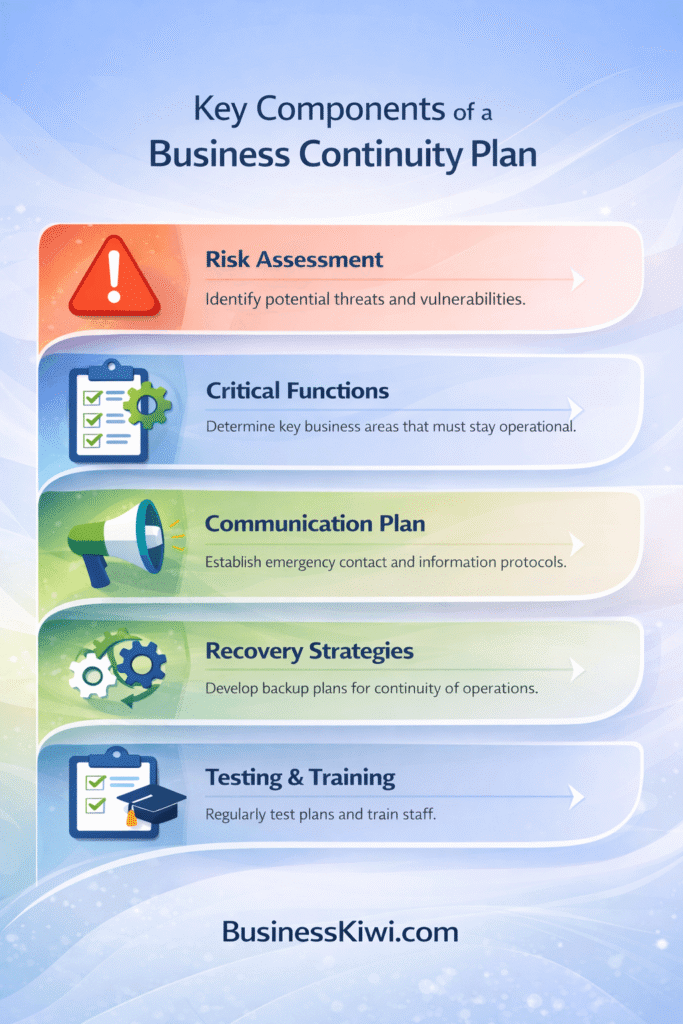

Practical Business Continuity Planning Framework (NZ)

A simple, effective NZ business continuity plan can be built using the following framework.

Step 1: Define Critical Activities

List activities that must continue or restart within days, not weeks.

Step 2: Assign Responsibility

Identify who is responsible for decisions and actions during disruption.

Step 3: Identify Backup Options

Document realistic alternatives for:

- Work locations

- Systems access

- Suppliers

- Staff coverage

Step 4: Plan Communication

Define how staff, customers, and suppliers will be informed during disruption.

Step 5: Document and Test

Keep the plan short, accessible, and reviewed regularly.

Example Continuity Planning Table (NZ SME)

| Area | Primary Option | Backup Option |

|---|---|---|

| Work location | Office premises | Remote work from home |

| Accounting system | Cloud accounting platform | Accountant offline access |

| Payments | Online banking | Phone banking access |

| Key supplier | Local supplier A | Secondary NZ supplier |

| Customer communication | Mobile phone / SMS |

This type of table makes a continuity plan usable under pressure.

Common Business Continuity Mistakes in NZ

Many NZ businesses undermine continuity planning by making it too complex or unrealistic.

Common mistakes include:

- Using overseas templates without NZ adaptation

- Assuming unlimited staff availability

- Relying on a single supplier with no backup

- Failing to document system access and passwords

- Creating plans that are never reviewed

A short, realistic plan is more effective than a long, unused document.

Government Guidance and NZ Business Continuity Planning

New Zealand government resources provide useful frameworks for continuity and contingency planning. These resources are best used as guidance, not as finished plans. Each business should adapt them to its size, industry, and operational reality.

Government frameworks work best when combined with internal knowledge of how the business actually functions day to day.

Business Continuity Planning for Small and Medium NZ Businesses

For SMEs, continuity planning should remain proportionate. The goal is to reduce downtime and confusion, not to eliminate every risk.

Good SME continuity planning focuses on:

- Clear priorities

- Simple documentation

- Realistic backup arrangements

- Clear decision-making authority

Even basic continuity planning significantly improves resilience during disruption.

When to Review and Update a Business Continuity Plan

A business continuity plan should be reviewed:

- At least once per year

- After major operational changes

- After staff or system changes

- Following any significant disruption

Regular review ensures the plan remains practical and relevant.

Final Assessment for NZ Businesses

A business continuity plan is not a compliance exercise. For New Zealand businesses, it is a practical management tool that supports survival and recovery during disruption. Businesses that focus on realistic risks, critical functions, and simple execution are far better prepared when disruption occurs.

Frequently Asked Questions

Is a business continuity plan mandatory for businesses in New Zealand?

No. There is no blanket legal requirement for all NZ businesses to have a formal business continuity plan. However, many insurers, lenders, government contracts, and commercial partners expect businesses to demonstrate continuity planning as part of risk management.

How detailed does a business continuity plan need to be for a small NZ business?

For most small businesses, a short and practical plan is enough. The focus should be on identifying critical activities, knowing who makes decisions during disruption, and having realistic backup arrangements rather than producing a lengthy document that is never used.

What types of disruptions should NZ businesses realistically plan for?

Most NZ businesses are more likely to face operational disruptions such as loss of premises, staff unavailability, IT or system outages, supply chain delays, or regional infrastructure issues rather than large-scale disasters. A continuity plan should prioritise these realistic scenarios.

How is a business continuity plan different from emergency planning?

Emergency planning focuses on immediate safety and response, while business continuity planning focuses on keeping the business operating or recovering quickly after the initial event. Both are related, but they serve different purposes.

Can a business continuity plan reduce insurance or financial risk?

In many cases, yes. Having a clear continuity plan can help demonstrate risk awareness to insurers, lenders, and partners, and it may reduce the financial impact of downtime by shortening recovery time after disruption.