Complete Guide to Small Business Grants in New Zealand

Starting or growing a small business in New Zealand often requires access to capital. While loans and private investment are common funding options, many business owners overlook small business grants, despite the fact that grants can provide non-repayable support for capability building, innovation, and long-term growth.

Small business grants in New Zealand are not designed to fund everyday expenses or replace revenue. Instead, they are targeted tools intended to strengthen businesses by improving skills, productivity, innovation, and strategic capability. When approached correctly, grant funding can reduce risk, accelerate development, and contribute to stronger long-term business outcomes.

This guide explains what small business grants are available in New Zealand, how they work, who qualifies, and how to approach the application process realistically.

What Is a Small Business Grant in New Zealand?

A small business grant is financial assistance provided by government agencies, partner organisations, iwi groups, or approved institutions to support specific business activities. Unlike loans, grants generally do not need to be repaid, provided the funds are used for their approved purpose and reporting obligations are met.

Grants exist to support outcomes such as:

- Economic growth

- Capability development

- Innovation and productivity

- Job creation

- Regional and community development

Because grants are outcome-driven, they are competitive. Applicants must clearly demonstrate how their proposed activity aligns with the objectives of the funding programme.

How Small Business Grants Work in New Zealand

Most small business grants in New Zealand operate on a co-funding model. This means the business contributes part of the cost, while the grant covers the remaining portion. Co-funding ensures businesses are committed to the project and helps funding bodies manage risk.

Grants are typically:

- Project-based rather than ongoing

- Restricted to approved uses

- Subject to eligibility assessment

- Paid in stages or as reimbursement

- Supported by progress and outcome reporting

Understanding these conditions early helps business owners focus on grants that genuinely suit their situation.

Types of Small Business Grants Available in New Zealand

Small business grants in New Zealand fall into several broad categories. Identifying the correct category is an important first step.

Capability and Skills Development Grants

These grants focus on strengthening internal business capability rather than funding operations.

They commonly support:

- Business planning and strategy

- Financial management and forecasting

- Digital systems and process improvements

- Leadership and management training

These grants are particularly useful for startups and early-stage businesses building strong foundations.

Innovation and Research Grants

Innovation grants support businesses developing new products, services, or processes.

They may fund:

- Research and development activities

- Product testing and validation

- Process innovation

- Commercialisation planning

Applicants typically need to demonstrate genuine innovation and long-term commercial potential.

Productivity and Growth Grants

These grants help established businesses improve efficiency and scalability.

They may support:

- Technology upgrades

- Operational improvements

- Process optimisation

- Supply chain enhancements

Productivity grants are often used by SMEs preparing for growth or expansion.

Regional and Sector-Specific Grants

Some grants are targeted at:

- Specific regions

- Priority industries

- Local economic development initiatives

Eligibility may depend on business location, industry alignment, or regional impact.

Export and Market Development Grants

These grants help businesses explore or enter new markets.

Typical uses include:

- Market research

- Export readiness planning

- Trade event participation

- International growth preparation

They are best suited to businesses with established products or services.

Examples of Small Business Grants in New Zealand

| Grant or Programme | Who It’s For | Typical Funding Range | Main Purpose |

|---|---|---|---|

| WINZ Self-Employment Grant | Benefit recipients | Up to $5,000 | Startup costs |

| RBP Capability Development Vouchers | Small and medium businesses | $1,000–$5,000 | Training and advisory support |

| Innovation and R&D Support | Innovative businesses | $5,000–$500,000+ | Research and development |

| Māori Business Development Funding | Māori-owned enterprises | Varies | Capability and growth |

| Regional Development Grants | Region-based businesses | $1,000–$50,000+ | Local economic growth |

The Role of the Regional Business Partner Network (RBP)

Many small business grants in New Zealand are accessed or assessed through the Regional Business Partner (RBP) Network. RBPs act as a gateway between businesses and government-supported funding programmes.

RBP advisors typically:

- Assess business eligibility

- Identify suitable funding options

- Recommend businesses for grants or vouchers

- Support capability development planning

In many cases, businesses must engage with an RBP advisor before applying for grant funding. Understanding this process early can significantly improve approval chances and prevent wasted applications.

Māori Business Grants and Funding Support in New Zealand

New Zealand offers specific funding pathways designed to support Māori entrepreneurs and Māori-owned businesses.

These programmes focus on:

- Sustainable enterprise development

- Capability building

- Long-term economic outcomes for Māori communities

Support may include grant funding, advisory services, mentoring, and partnership opportunities. Eligibility typically depends on ownership structure and alignment with Māori economic development objectives.

Small Business Grants for Startups

Startups face unique challenges, and not all grants are suitable for very early-stage businesses.

Startup-focused grants typically support:

- Business planning and validation

- Early capability development

- Innovation and product development

Startups are generally better positioned when applying for grants that focus on capability building rather than rapid expansion.

How Much Funding Can Small Businesses Receive in New Zealand?

Grant amounts vary widely depending on the programme and business circumstances.

Typical ranges include:

- Startup grants: up to $5,000

- Capability grants: $1,000–$10,000

- Productivity grants: $5,000–$50,000+

- Innovation and R&D grants: $10,000–$500,000+

Funding levels depend on business size, project scope, co-funding capacity, and alignment with funding objectives.

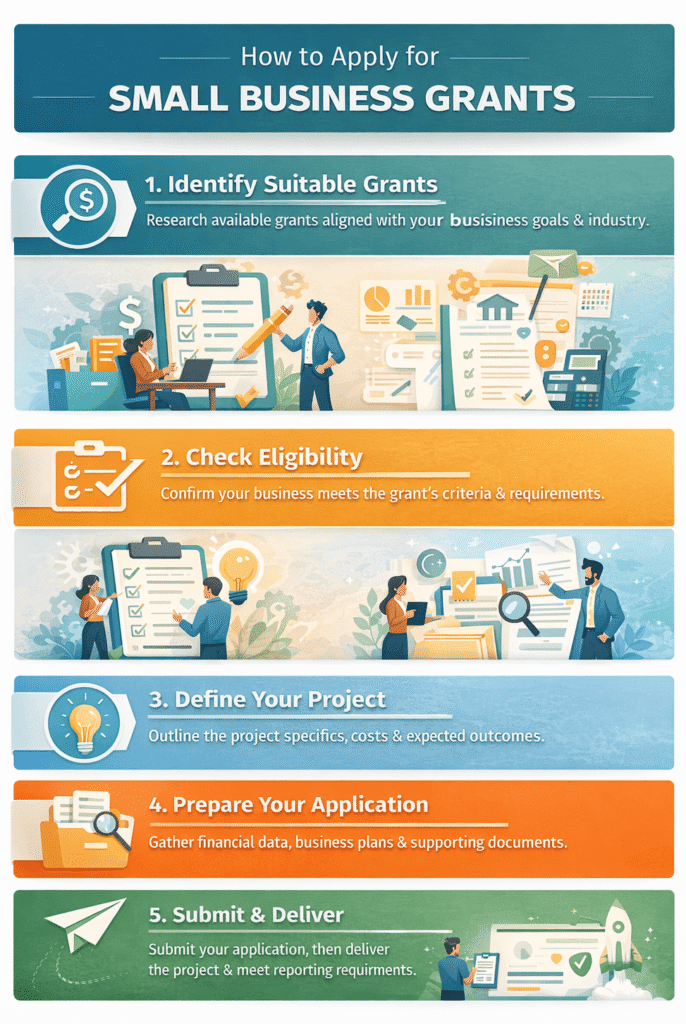

How to Apply for Small Business Grants in New Zealand

The grant application process requires preparation and clarity.

Step-by-Step Overview

- Identify grants aligned with your business goals

- Confirm eligibility requirements

- Define a clear, fundable project

- Prepare financial and supporting documentation

- Submit the application

- Deliver the project and meet reporting obligations

Businesses that treat applications as structured projects tend to achieve better outcomes.

Common Reasons Grant Applications Fail

Many applications fail due to avoidable issues, including:

- Applying for unsuitable grants

- Weak or unclear project definitions

- Unrealistic budgets or timelines

- Lack of capability to deliver the project

- Treating grants as general funding

Successful applications are realistic, focused, and well-aligned with funding objectives.

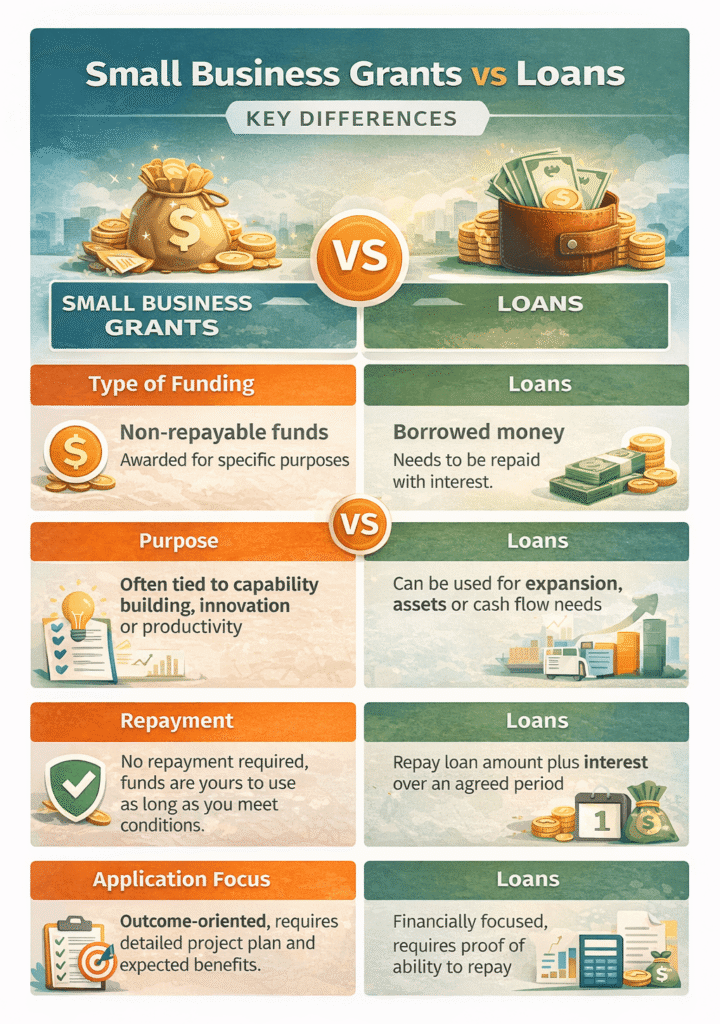

Business Grants vs Loans: What’s the Difference?

| Factor | Business Grants | Business Loans |

|---|---|---|

| Repayment | Usually not required | Must be repaid with interest |

| Eligibility | Strict and purpose-based | Credit and cash-flow based |

| Use of Funds | Restricted | Flexible |

| Risk to Business | Lower financial risk | Higher financial risk |

Businesses often compare grant funding with business loan options in New Zealand when deciding how to finance growth. Each option serves a different purpose and should be chosen based on long-term planning rather than short-term convenience.

How Grants Fit Into Long-Term Business Planning

Grants are most effective when integrated into broader business planning rather than pursued in isolation. Businesses that understand their financial position, manage cash flow during growth, and focus on understanding business value tend to use grant funding more strategically.

When aligned with long-term goals, grants can strengthen capability, reduce growth risk, and support sustainable business development.

Final Thoughts: Maximising Your Chances of Success

Small business grants in New Zealand offer genuine opportunities for entrepreneurs who approach the process strategically. While grant funding is competitive, businesses that apply for the right programmes with clear, realistic projects are well positioned for success.

Grant funding should be viewed as a strategic tool, not a shortcut. When combined with solid planning and disciplined execution, grants can support capability building, innovation, and long-term growth.

FAQs

Are small business grants in New Zealand really free money?

Small business grants usually do not need to be repaid, but they are not free money. Grants are provided for specific purposes, and businesses must use the funds exactly as approved and meet reporting requirements. If the conditions are not followed, funding can be reduced or withdrawn.

Can a new startup apply for small business grants in New Zealand?

Yes, some grants are available to startups, especially those focused on business planning, capability building, or innovation. Most grant providers expect startups to have a clear business plan, defined objectives, and a realistic project rather than just an idea.

Do I need to be profitable to qualify for a business grant?

Profitability is not always required. Many grants support early-stage growth or capability development. However, businesses usually need to show they are viable, well-managed, and capable of delivering the project the grant is intended to fund.

Why do so many small business grant applications get declined?

Applications are commonly declined because they are not aligned with the purpose of the grant, lack a clear project plan, or include unrealistic budgets and timelines. Grant providers focus on outcomes, so requests for general expenses or vague goals are less likely to succeed.

Should I use a grant or a loan to fund my business growth?

Grants are best suited for specific projects such as training, innovation, or productivity improvements. Loans are more appropriate for operational costs, asset purchases, or managing cash flow. Many businesses use a combination of both as part of a balanced funding strategy.

![How to Start an Ecommerce Business in NZ [2025 Guide]](https://businesskiwi.com/wp-content/uploads/2025/11/How-to-Start-an-Ecommerce-Business-in-NZ-644-300x200.png)