Mastering Finance for Specialised Mining & Quarry Equipment

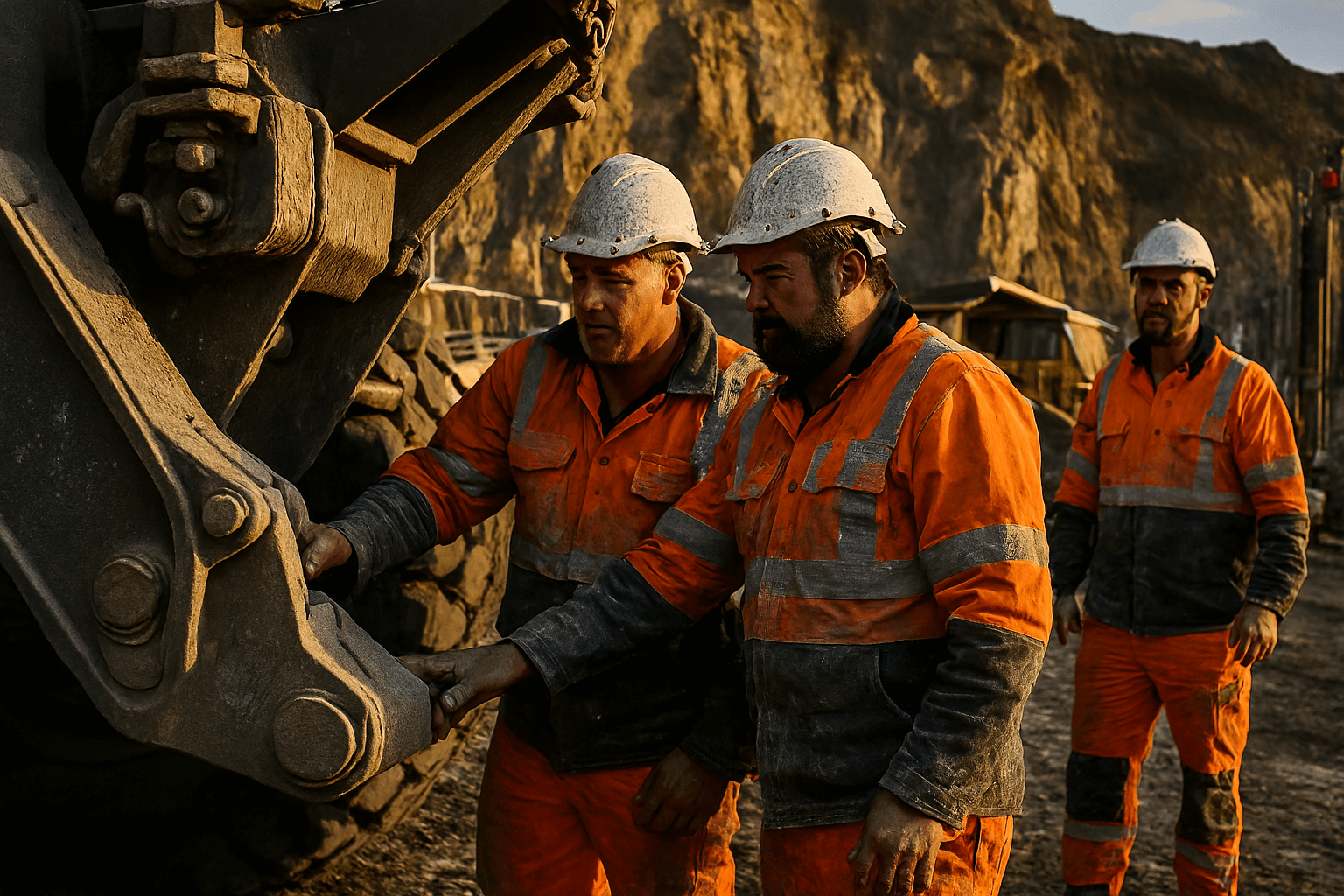

The ground doesn’t give up its treasures easily. The mining and quarrying industry is tough, whether you’re getting limestone for building or precious metals for technology. It takes determination, grit, and, most importantly, the right tools.

But anyone who works in this field knows that the “right tools” aren’t things you can buy at the store. We are talking about huge crushers, specialized excavators, drill rigs, and articulated dump trucks that can handle tough conditions. This equipment is essential to your business, but buying it will cost a lot of money.

For a lot of businesses, buying these assets outright isn’t just hard; it’s also not a smart move. It ties up cash flow that could be better used for growth or day-to-day costs. This is where getting the best financing for specialized mining and quarry equipment becomes an important business skill. This guide will help you find your way around the complicated world of heavy machinery financing so that your business can keep running without running out of money.

Understanding How Much Mining and Quarry Equipment Costs

Understanding How Much Mining and Quarry Equipment Costs

What makes specialized tools so expensive? It all comes down to how well it is built and how long it lasts. Mining equipment is often custom-made, unlike regular construction tools. It can work around the clock in very hot or very cold weather and handle rough materials that would break down other machines in weeks.

You aren’t just paying for steel and hydraulics when you buy a new screening plant or a specialized loader. You are paying for:

- Customization: You may need to change the machinery to fit the geology of your site.

- Technology: New tools come with advanced telemetry, automation, and safety systems.

- Longevity: If you take care of these assets properly, they should last a long time.

Lenders sometimes see these assets differently than regular cars because they are so specialized. They lose value at different rates and have a smaller market for resale. If you don’t work with a broker who knows how much the iron is worth, it can be hard to find easy equipment financing.

Ways to Get Money for Mining and Quarry Equipment

In this field, one size rarely fits all. The financial structure that works for a junior miner looking for a new tenement probably won’t work for an old quarry that needs to replace its old fleet. Here are the main ways to pay for heavy machinery.

Chattel Mortgage

This is a common choice for businesses that want to own the asset right away. With a Chattel Mortgage, the lender gives the supplier money to buy the equipment, and you own it right away. You then pay the lender back over a fixed term.

- Best for: Companies that want to deduct interest and depreciation costs from their taxes and plan to keep the equipment for a long time.

Finance Lease

A finance lease is a good option if you want to keep working capital but still want the equipment on your books. Equipment is purchased by the lender and rented to you by the lender. You are responsible for getting rid of the item at the end of the lease, which usually means paying a residual value to take ownership.

- Best for: businesses that want to own the asset in the end and are good at managing cash flow.

Lease for Business

An operating lease is great for equipment that you only need for one project or that you want to upgrade often to keep it from becoming outdated. You basically rent the equipment for a certain amount of time. At the end of the term, you hand it back.

- Best for: Projects that don’t last long or keeping up with the latest technology without having to own or throw it away.

Importing and Currency Finance

Much of the specialized heavy machinery used in mining is manufactured overseas—in Germany, Japan, or the US. This adds a layer of difficulty: foreign exchange.

If you pay for equipment in USD or Euro when your income is in local currency, you are taking a risk. Currency finance helps with this. It lets you pay for the purchase in the foreign currency or protect yourself against changes in the exchange rate.

Here, it’s very important to know about currency finance rates. If the exchange rate changes between when you order a crusher and when it ships, the price could go up by tens of thousands of dollars. Specialized trade finance services can lock in costs and take care of the logistics of paying suppliers in other countries, making sure that the machine arrives at your site without going over budget.

Advice on Getting a Loan

To get the money you need, you need to plan ahead. Lenders need to know that the equipment will make money, not just cost money.

1. Explain the “Why”

Don’t just ask for money to buy a bulldozer. Tell me what the contract will do. Will it make production go up by 20%? Will it cut down on downtime? Lenders love assets that make money.

2. Get Your Finances Ready

Ensure your balance sheet is up to date. Having clean, organized finances is the quickest way to get a “yes” if you want to get easy equipment financing.

3. Think about the asset’s life cycle

Find the right finance term for the asset’s useful life. You don’t want to be paying off a machine for five years if it’s going to be thrown away in three.

4. Get help from experts in the field

Generalist banks often struggle to value specialized mining gear. They might think that a “rock crusher” is very dangerous. A specialist broker knows that a quality crusher holds value well. They can make your case stronger and find lenders who are interested in the industry.

Examples: Financing Equipment Successfully

To show how this works in real life, let’s look at two examples from the industry that are common.

Scenario A: The Quarry Upgrade

The Challenge: The main crusher at a limestone quarry owned by a family needed to be replaced. The old unit was causing problems that cost them $5,000 a day in lost production. The new unit cost over $1.5 million.

They chose a Chattel Mortgage structure as the solution. The payments were set up so that they would be lower in the first three months (the installation phase) and higher once production picked up. This was because the new machine would quickly increase output.

The result was that the quarry’s production went up by 30% in the first quarter, which easily covered the costs of the loan.

Scenario B: The Junior Miner

The Problem: A small gold mining company got a new site, but they needed three articulated dump trucks right away to start stripping overburden. They didn’t have enough money to buy them all at once.

The answer was that they used an operating lease. This kept the debt off their balance sheet, which was important for their investors, and let them return the trucks when the 24-month stripping contract was over.

The result: They finished the first phase of the mine without losing any equity or running out of cash.

Making sure your business’s future

The mining and quarrying industry needs a lot of money, but it can also respond to changes in capital. The right tools, when paid for in the right way, work like a lever to increase your output and profits.

The most important thing is to get expert advice, whether you’re looking at domestic machinery or trying to figure out how to finance imported giants. You need a partner who knows that a drill rig isn’t just a truck; it’s the start of your income stream.