What Does ETC Stand for in Finance? A Full Guide

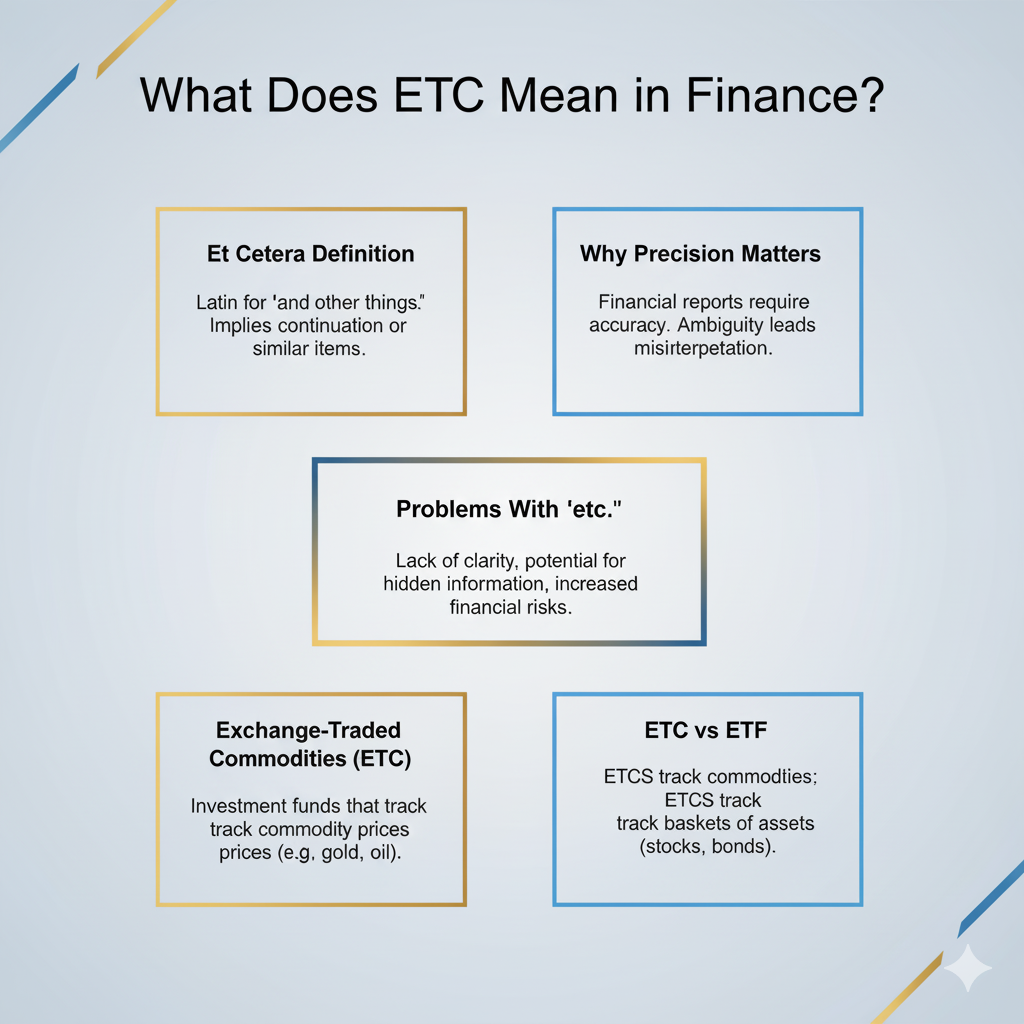

You’re not the only one who has seen “etc.” in a financial document and wondered if it should be there. “Etc.” is a common word in everyday writing, but its use in finance is much more complicated than you might think.

It’s not just about grammar to know how to use abbreviations and terms correctly in finance. It’s about being clear, following the rules, and keeping your business safe from expensive mistakes. When you’re writing contracts, looking at investment options, or making financial reports, knowing when and how to use “etc.” can make a big difference.

In this guide, we’ll talk about what “etc.” means, why you shouldn’t use it in financial situations, and what you should use instead. We’ll also talk about Exchange Traded Commodities, which is another kind of “ETC” that comes up in finance, and how it is different from ETFs.

What Does “Etc.” Stand For?

The Latin phrase et cetera, which means “and the rest” or “and so forth,” is where the abbreviation “etc.” comes from. It means that the list goes on past the items that are clearly listed.

You could say, “We need office supplies—pens, paper, folders, and so on.” The reader understands you’re referring to similar items without listing every single one.

This works well for talking to people in a casual way. But the rules for finance are different.

Why Finance Demands Precision

Financial papers are very important. They help people decide where to put their money, make sure they follow the rules, and make contracts that are legally binding. Ambiguity in these situations doesn’t just cause confusion; it can also cause fights, fines from regulators, and money loss.

Think about the words used in finance. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), ROI (Return on Investment), and CAGR (Compound Annual Growth Rate) are all terms that are meant to be exact. Each one gives stakeholders the information they need to make choices.

Using vague words like “etc.” in this setting makes things unclear. What does “etc.” really mean? Different readers might interpret it differently, and that’s where problems begin.

Where “Etc.” Falls Short in Financial Documents

Let’s look at real-life situations where “etc.” causes problems.

Investment Information

Think about reading an investment prospectus that says, “This fund buys stocks in tech companies like Apple, Microsoft, Amazon, and others.”

What does “etc.” mean in this case? Does it include tech companies that are smaller? New businesses? Companies that make hardware? Companies that offer software as a service? Without specificity, investors can’t accurately assess risk or align the investment with their goals.

Reports of Expenses

Think about an expense policy that says, “Expenses that can be reimbursed include travel, meals, lodging, and so on.”

Does “etc.” include entertaining clients? How much do the conference fees cost? Equipment for the home office? Employees may file claims that they think are covered, but they may be turned down. This makes people angry and breaks their trust.

Audit Trails

Every claim in financial statements needs to be checked by auditors. When a document says “revenue streams including product sales, subscription fees, licensing, etc.,” auditors have to find out what “etc.” means. This wastes time and can raise red flags during compliance reviews.

Contractual Obligations

Vague language in contracts can make them completely void. A clause that says “The vendor will provide services such as consulting, training, support, etc.” can lead to disagreements. What services are actually included? Enforcement is almost impossible without clarity.

Best Ways to Write About Money

So, how do you stay away from these problems? Financial professionals use these tried-and-true methods.

Be Exhaustive When It Matters

If you need to make a list of things that are complete, include everything. Yes, it does take up more room. But precision protects everyone involved.

“Assets include cash, stocks, bonds, and so on.”

Write: “Assets are things like cash equivalents, stocks that are traded on the stock market, bonds issued by companies and the government, real estate holdings, and intellectual property.”

Use qualifying phrases

When you want to say that a list isn’t complete but don’t want to use “etc.,” use clear qualifying language.

“Expenses can include rent, utilities, office supplies, and other things.”

Write: “Office supplies, utilities, and rent are just a few examples of expenses.”

This wording suggests that other things may apply while still following professional standards.

Give Examples That Are Representative

You might be showing a category instead of making a list that everyone has to follow. In these situations, make sure to be clear about what you want.

Instead of: “Costs of running a business, like salaries, equipment, marketing, etc.”

Write: “Costs of doing business, like paying employees, fixing equipment, and marketing, are just a few examples of operational expenses.”

Supporting Documentation Reference

For long lists, send readers to full resources.

Instead of: “Following rules like SOX, GDPR, etc.”

Write: “Complies with rules like SOX and GDPR.” For a full list of the rules that apply, see Appendix B.

The Effect on Compliance and Auditing

Regulatory bodies look very closely at financial documents. The SEC, IRS, and their counterparts in other countries all want accuracy. Using words like “etc.” that aren’t clear can lead to more reviews, longer wait times for approvals, or even fines.

Auditors look for vague language as a sign of trouble. It could mean that someone is being careless or trying to hide information. Neither of these explanations helps your case.

Using clear, specific language shows that you are professional and honest. It shows that you know what you have to do and take it seriously.

ETC in finance stands for exchange-traded commodities.

Let’s talk about another “ETC” that you might come across in finance: Exchange Traded Commodities.

What Are ETCs?

Exchange Traded Commodities (ETCs) are ways to invest that follow the prices of basic goods like oil, gold, or farm products. Like stocks, they are traded on stock exchanges.

ETCs let investors get involved in commodity markets without having to own the actual commodities. This makes them easy to get to and fairly liquid compared to buying commodities directly.

ETC vs. ETF: The main differences

People often mix up ETCs and ETFs (Exchange Traded Funds), but they are not the same.

Structure: ETFs are usually funds that own a group of securities. ETCs are debt instruments that are backed by commodities or derivatives of commodities.

Regulation: ETFs are usually treated like investment funds by the law. Different rules apply to ETCs depending on where they are located.

Risk Profile: ETCs are debt securities, so they have counterparty risk. If the issuer fails, you could lose your investment. This risk structure isn’t the same for ETFs.

Dividends: Most ETCs don’t pay dividends because the commodities they own don’t make money. Some ETFs pay out dividends from the stocks they own.

What you need to know about inverse and leveraged ETCs

You might come across words like “inverse” or “leveraged” when you look into ETCs.

When the price of the underlying commodity goes up, inverse ETCs go down. An inverse oil ETC would go up about 1% if oil prices went down 1%. These are used by investors to make money when commodity prices go down.

Leveraged ETCs make returns bigger. A 2x leveraged gold ETC would try to give you twice the daily return of gold prices. These products are complicated and only good for experienced traders because they can make losses as well as gains bigger.

Before you think about these products, you need to know what leverage means in trading. Leverage lets you control a big position with less money, but it also raises the stakes for both profits and losses.

Practical Examples of Clear Financial Language

Let’s look at some examples of how clear language makes a difference.

Example 1: Description of an investment portfolio

Before: “The portfolio includes stocks, bonds, real estate, and other investments.”

After: “The portfolio is made up of 60% domestic stocks, 25% investment-grade bonds, 10% international stocks, and 5% real estate investment trusts (REITs).”

Example 2: How the fees work

“Fees include management fees, transaction costs, and so on.”

After: “The total expense ratio includes a management fee of 0.75% per year, trading commissions that average 0.10% per transaction, and administrative costs of 0.05% per year.”

Example 3: Telling people about risks

Before: “Risks are things like changes in the market, currency rates, etc.”

After: “The main risks are changes in interest rates, credit risk, liquidity risk, and market volatility. Please refer to the full risk disclosure document for comprehensive details.”

Why accuracy is important beyond following the rules

Clear financial communication builds trust. Clients and stakeholders know exactly what to expect when you are clear. They can make smart choices without worrying about what you really want.

This clarity also keeps you safe in court. Well-documented, specific language makes it easy to see what was agreed upon if there are any disagreements.

This level of accuracy also applies to how businesses talk to each other. When teams know exactly what is expected of them, without vague “etc.” clauses, they do a better job.

Making Financial Communication Your Strong Point

One part of good financial communication is knowing what “etc.” means in finance and when to stay away from it. The rule applies to all of your business writing.

Every word you choose and every sentence you make either makes things clearer or less clear. In finance, being clear always wins.

Be specific when writing financial documents, making investment materials, or just trying to talk about money matters more clearly. Set the rules for your terms. Write down everything you have. Use qualifying phrases when they make sense. Reference the supporting documents.

These habits don’t just make one document better. They make you look better in your field and lower the risk for your whole business.

Work with people who know how to make money clear.

It takes skill to handle the difficulties of talking about money. When you make financial models, compliance documents, or investor presentations, accuracy is important.

We at Business Kiwi know how important it is to communicate financial information clearly and correctly. Our team helps businesses write documents that are both compliant with regulations and easy for stakeholders to understand. We know that using vague language is risky, and we want to help you talk to people with confidence.

Are you ready to improve your financial paperwork? Make an appointment with Business Kiwi today to learn how professional help can change the way you talk to your customers.