How to present a business plan to a bank

For any business owner, going into a bank to ask for money can feel like the most important thing they will ever do. You’ve put in a lot of time and effort into your business idea, and now you need money to make it happen or move it forward. A well-thought-out business plan and a confident presentation are the keys to making that important meeting a success.

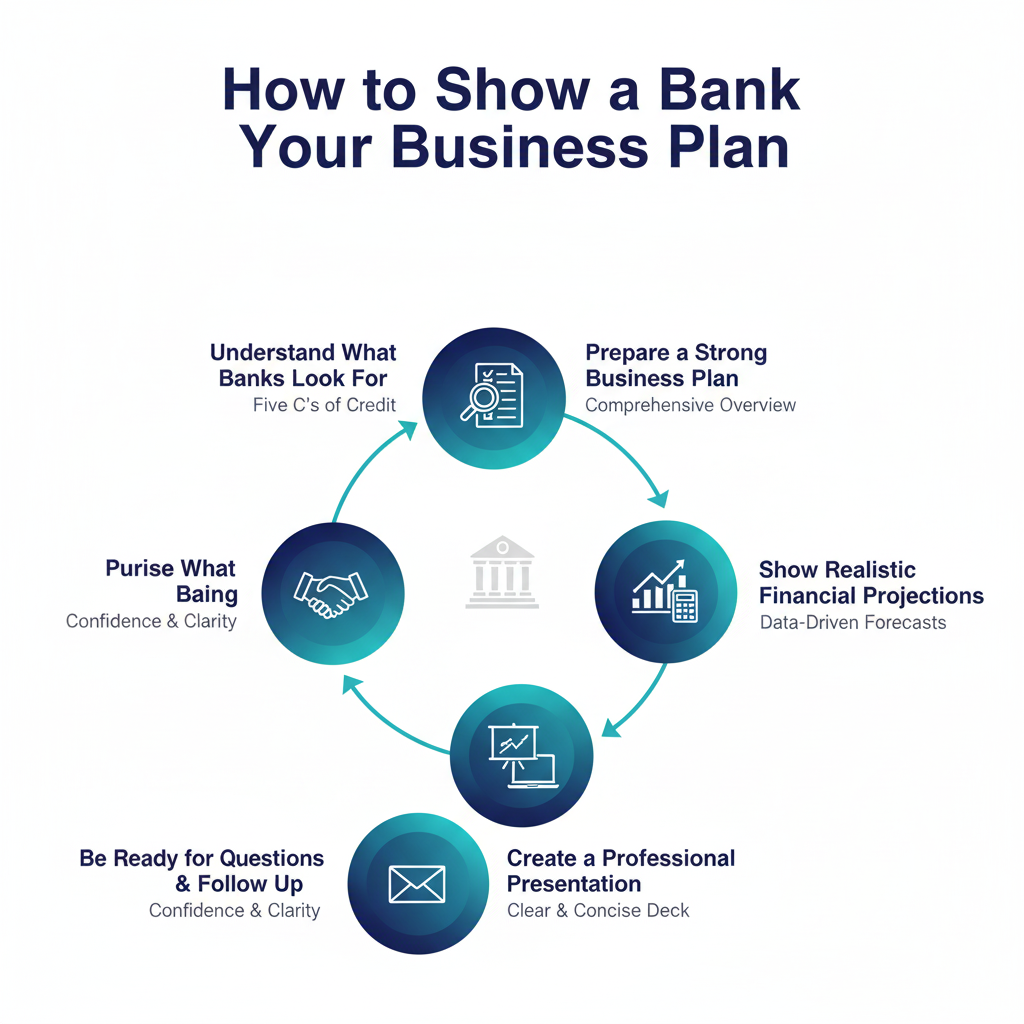

This complete guide will show you exactly how to show a bank your business plan. We’ll talk about everything from getting inside the lender’s head to making your financial projections and giving a presentation that makes people trust you. By the end of this article, you’ll know exactly how to write a business plan that will get you a meeting and the money your startup needs to grow.

Getting the Bank’s Point of View

It’s important to know what lenders want before you even start writing your plan. Bankers are more than just investors; they are also people who manage risk. Their main goal is to get their money back, with interest. They will carefully look over your business plan to see if it is possible and if you can pay back the loan.

A loan officer knows what to look for:

- The “Five C’s of Credit”: This is a common way for banks to look at loan applications.

- Character: Your reputation, experience, and track record. They want to know that you can be trusted and that you can do the job.

- Capacity: Your ability to pay back the loan. Your cash flow projections will tell you this.

- Capital: The amount of your own money that you have put into the business. Banks want to know that you have something to lose.

- Collateral: Things you own that you can use to back up the loan. This lowers the bank’s risk if you don’t pay.

- Conditions: The loan’s terms, as well as the state of the economy and trends in your industry that could affect your business.

- A Plan That Is Clear and Realistic: Lenders read thousands of business plans. They can tell right away if an idea is unrealistic or not well-researched. Your plan needs to be based on good market research and reasonable assumptions.

- Your Management Team’s Expertise: They want to be sure that you and your team have the skills and experience to carry out the plan and deal with problems.

Important Parts of a Successful Business Plan

A business plan for a bank loan should be a full document that covers everything. A standard business plan template has the following parts, though the layout may change. This is the usual way to write a business plan for a bank or an investor.

1. Executive Summary

The executive summary is the most important part of your business plan. It gives a brief summary of the whole document, usually one to two pages long. It should be interesting enough to make the lender want to read the rest of the plan. After you’ve finished all the other parts, write this section last.

What to put in:

- Your mission statement.

- A brief description of your products or services.

- A brief description of your target market and what makes you better than your competitors.

- A highlight of the experience of your management team.

- Important financial information and forecasts.

- The exact amount of money you want to borrow and what you plan to do with it.

2. Company Description

This part gives a full picture of your business. It tells people who you are, what you do, and what you want to accomplish.

What to include:

- The type of business you have (e.g., sole proprietorship, LLC, corporation).

- A short history of the business (if it applies).

- Your values, mission, and vision.

- A clear explanation of what your goods or services are and how they help customers.

- Your business goals for the short and long term.

3. Market Analysis

You need to show that you really know your industry, target market, and competitors here. This part shows the bank that people really want what you have to offer..

What to include:

- Industry Overview: Size, growth rate, and key trends in your industry.

- Target Audience: A detailed profile of your ideal customer (demographics, psychographics, needs, and buying habits).

- Market Size: How big is the market you want to reach? Use facts to back up what you say.

- Competitive Analysis: Who are the main people you compete with? What are their good and bad points? What is your unique selling point (USP) that makes you stand out

4. Running and organizing things

People are just as important to investors and lenders as ideas are. This part talks about your team and how your company is set up.

What to put in:

- A chart that shows how the organization is set up.

- Biographies of important members of the management team that show their relevant experience and skills.

- Duties and responsibilities for each important job.

- Details about any advisors, board members, or legal counsel.

5. Goods or Services

Give a detailed description of what you’re selling. Think about how much your customers value what you offer.

What to add:

- Detailed descriptions of the things you sell or do.

- How you set your prices.

- Details about the suppliers and how the goods are made.

- Any patents, trademarks, or copyrights you own.

- Plans for making new products in the future.

6. Plan for marketing and sales

How will you get in touch with your ideal customers and convince them to buy from you? This part explains how you plan to get and keep customers.

What to include:

- Your marketing plan, which could include things like digital marketing, content marketing, social media, and public relations.

- Your plan and process for making sales.

- Your plan for customer service and support.

- Your plan for branding and positioning.

Making financial projections that are realistic and interesting

The most important part of your business plan for a bank loan is your financial projections. They put your strategic plan into numbers. You should be realistic and support your ideas with facts. You should usually include predictions for the next three to five years.

Important Financial Statements to Include:

- Profit and Loss Statement: This shows how much money you think you’ll make, spend, and make a profit over a certain amount of time.

- Cash Flow Statement: The cash flow statement is probably the most important statement for a lender. It keeps track of how much money comes in and goes out of your business and lets you know if you can pay your bills and loans.

- Balance Sheet: This shows your company’s financial health at a certain point in time by listing its assets, liabilities, and equity.

- Break-Even Analysis: This analysis shows the point at which your income and expenses are equal, which means you are no longer losing money.

Make sure your financial assumptions are clear and well-documented when you write a business plan to get money. For instance, if you think sales will go up by 20%, you should say why you think that will happen, using your marketing plan or market analysis as an example.

Some tips for giving a presentation: How to Show Off Your Business Plan

Once your document is complete, you need to prepare for the presentation. The way you present your plan can be just as important as the plan itself. Here are some examples and tips for business plan presentations.

Make a plan for your presentation

Your presentation should be a concise version of your business plan. A 10-20 slide deck is usually sufficient.

- Slide 1: Title Slide: Your name, the name of your company, and the logo.

- Slide 2: The Issue: Clearly define the problem your business solves.

- Slide 3: The Solution: Present your product or service as the answer.

- Slide 4: Market Opportunity: Briefly cover your target market and its size.

- Slide 5: Competitive Advantage: Tell us what sets you apart and makes you better.

- Slide 6: Business Model: What do you do to make money?

- Slide 7: Marketing and Sales Plan: How will you get customers?

- Slide 8: The Team: Tell us about the most important people on your team.

- Slide 9: Important Financial Information: Present key numbers from your projections.

- Slide 10: The Request: State the loan amount and what it will be used for.

Delivery Strategies

- Practice, Practice, Practice: Rehearse your presentation until you can deliver it smoothly without reading from your slides. Ask for feedback after practicing in front of others.

- Be aware of your numbers:Be ready to talk about any number in your financial projections in detail.

- Tell a Story: Tell a good story about your business to get the lenders interested. Why did you start it? Who are you helping?

- Dress Professionally: Your appearance matters. Dress in professional business attire to show you are serious.

- Be Confident and Passionate: People can catch your enthusiasm for your business. Let them know that you believe in your plan and are determined to make it work.

Things You Shouldn’t Do

If the presentation is bad, even the best business ideas can be turned down. Here are some common mistakes to stay away from:

- Unrealistic Projections: A big red flag is when financial forecasts are too positive.

- Ignoring Weaknesses: No business is perfect. Being aware of possible risks and having a plan to deal with them shows that you are a realistic and ready leader.

- Not Knowing Who You’re Talking To: Make your plan and presentation fit the bank. Talk to them about what matters most to them: risk and repayment.

- Mistakes in spelling and grammar: A document that is full of mistakes shows that the person who wrote it is careless. Check everything for mistakes.

- Being Defensive: If lenders question an assumption, pay attention to what they say. Don’t be defensive; be open to talking.

Q&A Preparation: Anticipating Questions

After your presentation, the loan officers will have questions. It’s very important to be ready for them.

Expect tough questions, such as,

- “What will you do if sales are lower than expected?”

- “Why did you pick this pricing plan?”

- “What are you going to do if a new competitor comes into the market?”

- “ How much of your own money have you invested?”

- “What will you do if the first plan doesn’t work?”

Think of possible questions and write down short, well-thought-out answers. This shows that you did your research and thought about different possibilities.

Strategies for Following Up Well

After you leave the bank, you still have work to do. A strategic follow-up can help keep your application in the minds of others.

- Send a Thank You Important: Send a personalized email to the loan officers within 24 hours to thank them for their time. Quickly go over your main strengths and excitement again.

- Give more information right away: Send any extra documents or information they asked for as soon as you can.

- Respectfully Check In: If you haven’t heard back from them by the time they said they would, it’s okay to send a polite follow-up email.

![How to Show a Bank Your Business Plan When You Want a Loan [Guide for 2025]](https://businesskiwi.com/wp-content/uploads/2025/11/Show-a-Bank-Your-Business-Plan-475-1.png)

![How to Start an Ecommerce Business in NZ [2025 Guide]](https://businesskiwi.com/wp-content/uploads/2025/11/How-to-Start-an-Ecommerce-Business-in-NZ-644-300x200.png)