What is housing finance company

If you’re thinking about buying a house, you’ve probably heard the term “housing finance company” a lot. But what does it really mean? What makes these businesses different from regular banks? And most importantly, how can they help you reach your goal of owning a home?

This guide tells you everything you need to know about housing finance companies (HFCs). If you’re buying your first home or refinancing your current loan, knowing what HFCs are will help you make better financial choices.

We’ll look at what HFCs are, how they work, what services they offer, and why they are so important for making housing available to millions of people. By the time you finish reading this, you’ll know exactly how these specialized institutions work and if they’re the best option for your home financing needs.

What do housing finance companies (HFCs) do?

Housing finance companies are banks that only lend money to people who want to buy, build, or fix up their homes. HFCs only deal with credit for housing, while banks offer a wide range of financial products, such as savings accounts and business loans.

The Rules and Regulations

There are strict rules that HFCs must follow. In a lot of places, housing finance regulatory authorities or central banks set rules for how they work. These rules make sure that HFCs keep their finances stable, lend money in a fair way, and look out for the best interests of their customers.

The regulatory framework usually includes things like:

- Requirements for capital adequacy

- Standards for lending and the ratio of loan to value

- Limits on interest rates and rules for disclosure

- Rules for managing risk

- Ways to deal with customer complaints

Main jobs of HFCs

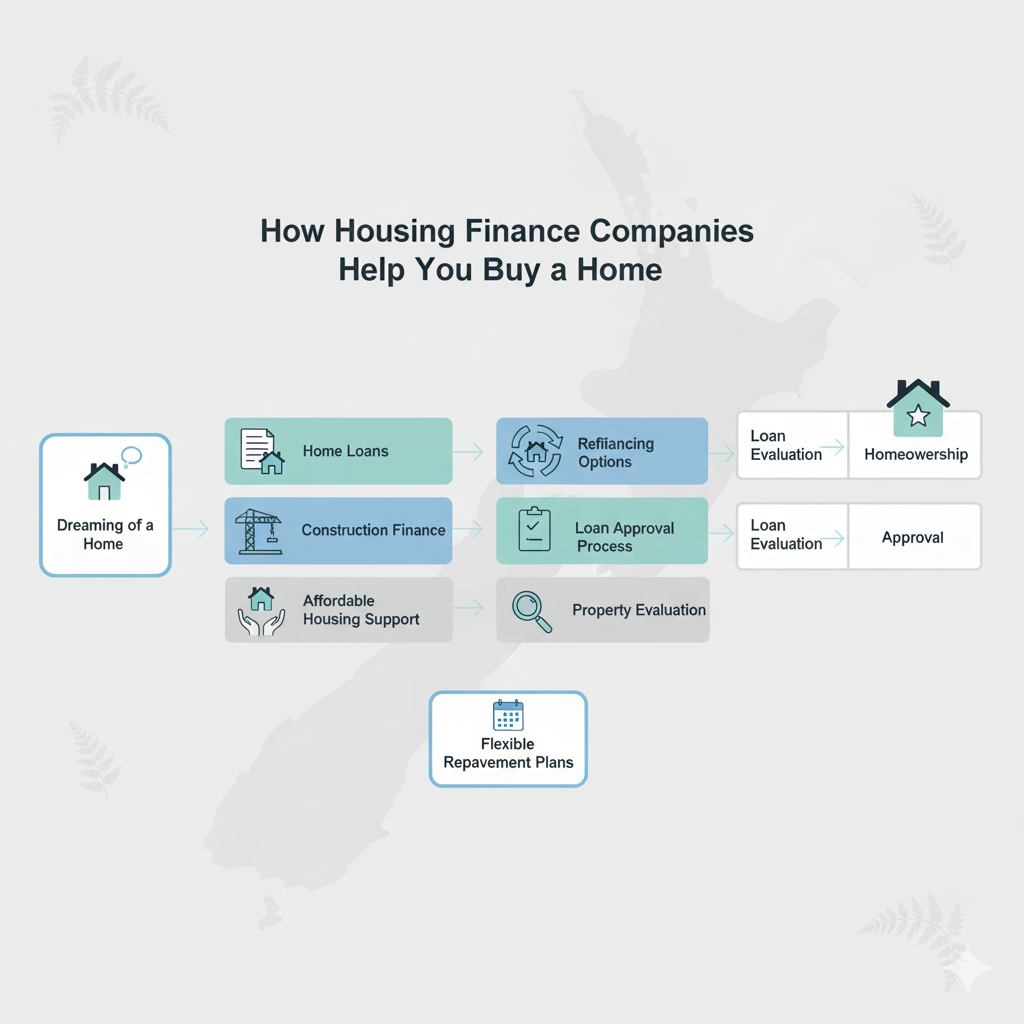

Housing finance companies have three main goals that make up their core mission:

Offering home loans: HFCs have a range of loan products for different types of customers, from low-income families who need affordable housing loans to high-end home loans for luxury homes.

Making construction finance easier: They give money to builders and developers for residential construction projects, which indirectly increases the number of homes available.

Encouraging homeownership: HFCs make it easier for people to buy homes instead of renting them forever by offering low rates and flexible payment plans.

What HFCs do in the housing market

Housing finance companies help people get from their dreams of owning a home to the reality of it. Because they only focus on one thing, they know more about the housing market than generalist banks do.

Making it easier to own a home

HFCs have made homeownership more accessible by making loans that are tailored to people with different income levels. They understand that a young professional buying their first apartment has different needs than a family upgrading to a larger home.

Many HFCs require lower down payments than traditional banks, which makes it easier for first-time buyers to buy a home. They also give you longer repayment terms, which makes your monthly payments less of a burden.

Contributing to Affordable Housing

One of the most important things that HFCs do is focus on affordable housing. They have created special loan products for people with low incomes and people who are financially weaker, often in collaboration with government housing programs.

These organizations know that affordable housing isn’t just about getting a smaller loan. It’s about knowing that informal sector workers don’t always get paid on time, accepting different types of paperwork, and letting them pay back their loans on a flexible schedule.

Effect on the growth of cities and towns

HFCs are very important for balanced growth in regions. Housing finance has always been popular in cities, but many HFCs have also started to lend money for homes in semi-urban and rural areas, which are places that traditional banks often miss.

This expansion has a multiplier effect on local economies. Building homes creates jobs for both skilled and unskilled workers, increases the need for building materials, and boosts related industries.

HFCs and banks: What are the main differences?

Both banks and housing finance companies give out home loans, but there are some key differences between the two.

Focus on Lending

Banks are financial institutions that do a lot of different things. They have a lot of different products, including personal loans, business loans, credit cards, and deposit accounts. Home loans are just one of them. Because they work in a variety of fields, their knowledge is spread out over many.

HFCs, on the other hand, only work in housing finance. This focused approach helps them become more knowledgeable about property valuation, how the real estate market works, and how to make new housing loan products.

Loan Terms and Interest Rates

Depending on market conditions and how much it costs them to borrow money, banks and HFCs may have different interest rates. HFCs sometimes offer more competitive rates for specific customer segments because of their specialized focus and lower operational costs in the housing segment.

The terms of the loans are also different. HFCs are more likely to be flexible with repayment schedules and willing to change loan structures to fit the borrower’s cash flow.

Customer base and how you serve them

Banks typically target salaried individuals with stable incomes and strong credit histories. Their documentation requirements can be extensive, and approval processes often follow rigid criteria.

HFCs are usually more open to different ways of doing things. They’re often willing to work with self-employed individuals, those with non-traditional income sources, and customers with limited credit histories. They can look at risk in a different way than banks because they know a lot about the housing market.

Regulatory Oversight

Both institutions are regulated, but the rules and authorities that apply to each may be different. Banks are usually overseen by banking regulators, while housing finance companies (HFCs) are usually overseen by specialized housing finance regulatory bodies or separate divisions within central banks.

What Housing Finance Companies Do

HFCs offer a full range of services to meet a wide range of housing finance needs.

Home Loans of Different Types

Purchase loans: These are the most popular type of loan. They help you buy homes that are already built or homes that are still being built.

Construction loans: If you own land and want to build your dream home, construction loans give you money in stages as the work goes on.

Home improvement loans: These loans let you fix up, add on to, or remodel your current home without changing your original mortgage.

Plot loans: Some HFCs offer loans to buy residential plots, but these loans usually have stricter terms than construction loans.

Balance transfer loans: If you’re not happy with the interest rate or service from your current lender, HFCs can help you move your loan balance to a new lender.

Services for Refinancing Loans

You can get a new home loan through refinancing, which usually means getting a loan with lower interest rates or better terms. HFCs have made the refinancing process easier, which can save you a lot of money over the life of your loan.

When you refinance, you look at your current loan, the value of your property, and whether it makes sense to switch lenders. A lot of people refinance to lower their monthly payments or shorten the length of their loan.

Construction Finance for Developers

Beyond individual home loans, many HFCs provide construction finance to real estate developers. This money helps builders finish homes, which makes more homes available and gives buyers more choices.

Project-based lending is the most common way to finance construction. Money is released in tranches as construction milestones are met. This makes sure that the money is used correctly and lowers the lender’s risk.

Additional Services

HFCs today do more than just lend money. A lot of them offer extra services that add value, such as:

- Help with property insurance

- Legal and technical advice services

- Services for valuing property

- Help with tax breaks for home loans

- Financial planning consultation

How HFCs Work: An Explanation of the Business Model

You can better understand the role of housing finance companies in the financial ecosystem if you know how they make money and manage risk.

Sources of Funding

HFCs get money in a number of ways:

Bank loans: They get money from commercial banks at wholesale rates.

Bond issuance: Many HFCs issue bonds in capital markets to raise long-term funds.

Deposits: Some HFCs take deposits from the public, but there are rules that limit this.

Securitization: They put together groups of home loans and sell them to investors, which gives them more money to lend.

Equity capital: The first money comes from shareholders and promoters.

The Process for Approving Loans

Here’s what usually happens when you ask an HFC for a home loan:

Submitting an application: Means giving basic information about yourself, the property, and your finances.

Verification of documents: The HFC checks your credit history, identity, income, and job history.

Property evaluation: They conduct technical and legal due diligence on the property to ensure it’s worth the loan amount and has clear title.

Credit assessment: Your creditworthiness is based on how stable your income is, how many debts you already have, and your credit score.

Loan approval: If everything looks good, the loan is approved with certain terms and conditions.

Disbursement: Money is given to the seller all at once or in stages for properties that are still being built.

Strategies for Managing Risk

To keep their business safe, HFCs use advanced risk management methods:

Loan-to-value limits: They usually only lend a percentage of the property’s value (usually 75–90%), which makes sure that borrowers have something to lose.

Income verification: Thorough checks make sure that borrowers can afford the monthly payments.

Property insurance: Is required and protects both the borrower and the lender from damage to the property.

Diversification: HFCs lower concentration risk by lending to customers in different parts of the world and to different types of customers.

Provisioning: They set aside reserves for potential loan defaults.

Challenges Faced by Housing Finance Companies

HFCs face a number of big problems, even though they are very important.

Money Problems

Unlike banks that have access to low-cost deposits, HFCs rely primarily on borrowings and market-based funding. This can raise their cost of funds, especially when there isn’t much money available or the financial markets are under stress.

HFCs may have to slow down their lending or raise interest rates to cover the higher costs when money gets too expensive or hard to find.

Following the rules

The rules for housing finance are always changing. HFCs need to keep up with the rules about capital adequacy, lending, and reporting that are always changing. Compliance costs can be significant, especially for smaller HFCs.

It is still hard to balance the needs of the business with the needs of the law.

Banks are competing with each other.

As banks have become more aggressive in the home loan market, HFCs face intense competition. Large banks often have advantages in terms of:

- Access to deposits lowers the cost of funds.

- A lot of branches

- Brand recognition that has been built

- Opportunities for cross-selling

HFCs need to stand out by offering better service, unique products, or focusing on a specific market.

Asset-Liability Management

HFCs borrow short-term or medium-term funds but lend for long tenures (often 15-20 years). Managing this asset-liability mismatch is crucial. Their profitability goes down if they can’t refinance their loans at good rates.

Changes in interest rates make things even more complicated. When rates go up, HFCs with fixed-rate loans have to deal with lower margins.

Types of Housing Finance: Knowing Your Choices

There is no one-size-fits-all way to get housing finance. There are different types of housing finance products that meet different needs:

Based on the type of property

- Residential home loans: For buying or building homes where you will live

- Investment property loans: to buy rental properties

- Commercial property loans: Some HFCs do lend money for commercial real estate, but this is not very common.

Based on the structure of interest rates

- Fixed-rate loans: Interest rate remains constant throughout the loan tenure

- Floating-rate loans: The interest rate changes depending on what is happening in the market.

- Hybrid loans: have both fixed and floating rate periods

Based on Borrower Profile

- Loans for salaried people: These are regular loans for people who work and earn money.

- Self-employed loans are made for business owners and professionals whose income changes from month to month.

- Loans for women: Some HFCs give women borrowers special rates or terms.

- Loans for seniors: These are special loans for older people, and they may include reverse mortgages.

By the Purpose of the Loan

- Purchase loans: To buy homes that are already built or being built

- Construction loans: To build homes on land you own

- Extension loans: To build more floors or rooms onto existing buildings

- Repair loans: to fix up or keep up your home

Housing Finance Company Pay and Job Opportunities

If you’re considering a career in the housing finance sector, it’s worth understanding the employment landscape.

Job Duties in HFCs

Housing finance companies hire professionals to do a variety of jobs, such as

- Sales and marketing: Loan officers, relationship managers, and business development executives are all in charge of sales and marketing.

- Credit and underwriting: people who look at credit, process loans, and manage risk

- Operations: people who work on loans, people who collect money, and people who help customers

- Legal and technical: property appraisers, lawyers, and people who know how to write documents

- Support functions: People who work in HR, finance, IT, and compliance are support staff.

Ranges of pay

Salaries at housing finance companies depend on the job, the person’s experience, where they work, and the size of the company. Entry-level jobs like loan officers may pay low salaries at first, but experienced credit managers or regional heads can make a lot more money.

Senior positions in risk management, product development, or business strategy usually come with pay and benefits that are similar to those in the banking sector. Many HFCs also offer performance-based bonuses based on portfolio quality or loan disbursement goals.

People who learn how to assess credit, know about real estate markets, and build strong relationships with customers can have rewarding careers in HFCs.

The Future of Companies that Finance Homes

The housing finance sector is evolving rapidly, driven by technology, regulatory changes, and shifting customer expectations.

Changing Technology

Digital innovation is changing the way HFCs do business:

Online loan applications: Customers can now apply for home loans entirely online, uploading documents digitally and tracking application status in real-time.

AI-powered credit assessment: HFCs can use AI and machine learning to figure out if someone is creditworthy more quickly and accurately.

Blockchain for property records: New technologies promise to make checking property ownership faster and more accurate.

Mobile-first experiences: Apps allow borrowers to manage their loans, make payments, and access services from their smartphones.

Getting more people to see it

HFCs are paying more attention to markets that aren’t getting enough attention. Financial inclusion programs are making it easier for people in smaller towns and rural areas to get loans to buy homes, which was hard to do before.

HFCs are able to reach customers they couldn’t reach before by working with fintech companies.

Housing finance that lasts

Environmental awareness is having an effect on housing finance. Some HFCs give better rates to green homes or homes with energy-saving features. This trend toward sustainable lending is likely to accelerate.

The Role Ahead

Even though banks and other lenders are competing with them and getting money is hard, HFCs will still be very important for helping people buy homes. They are well-positioned for the future because they are flexible, focused on a specific area, and know how to serve a variety of customer groups.

The need for specialized housing finance institutions is even greater as cities grow and demand for housing rises. HFCs that keep up with new technologies, manage risk well, and put the customer first will do well.

Making Dreams of Homeownership Come True

Housing finance companies have changed the way people buy homes, making it possible for millions of people to own homes who might not have been able to do so otherwise. They are different from regular banks because they focus on housing finance, are flexible, and are dedicated to it.

If you’re thinking about buying your first home, building your dream home, or refinancing your current loan, it’s important to know how HFCs work so you can make smart choices. These places do more than just give you money; they also give you advice, expertise, and personalized solutions for your specific housing needs.

The housing finance industry is still changing, using technology and reaching out to groups that haven’t been served well in the past. These companies will continue to be important in making housing dreams come true as they come up with new ideas and change.