Planning for Retirement in New Zealand: Everything You Need to Know

Retirement planning in New Zealand is often described as something to think about later, once work, housing, and family costs feel more settled. In practice, retirement outcomes are shaped gradually, through ordinary decisions made over long periods rather than through a single well-timed plan. Income patterns, housing choices, health, market cycles, and government policy all influence how retirement looks, and none of these factors move in straight lines.

This article explains how retirement planning typically plays out for New Zealanders under current settings. It focuses on practical realities rather than ideal scenarios, recognising that many people experience interrupted savings, uneven income, and changing priorities across their working lives. The aim is not to provide instructions, but to describe the landscape as it exists so expectations are grounded in how retirement usually unfolds.

How retirement works in the New Zealand system

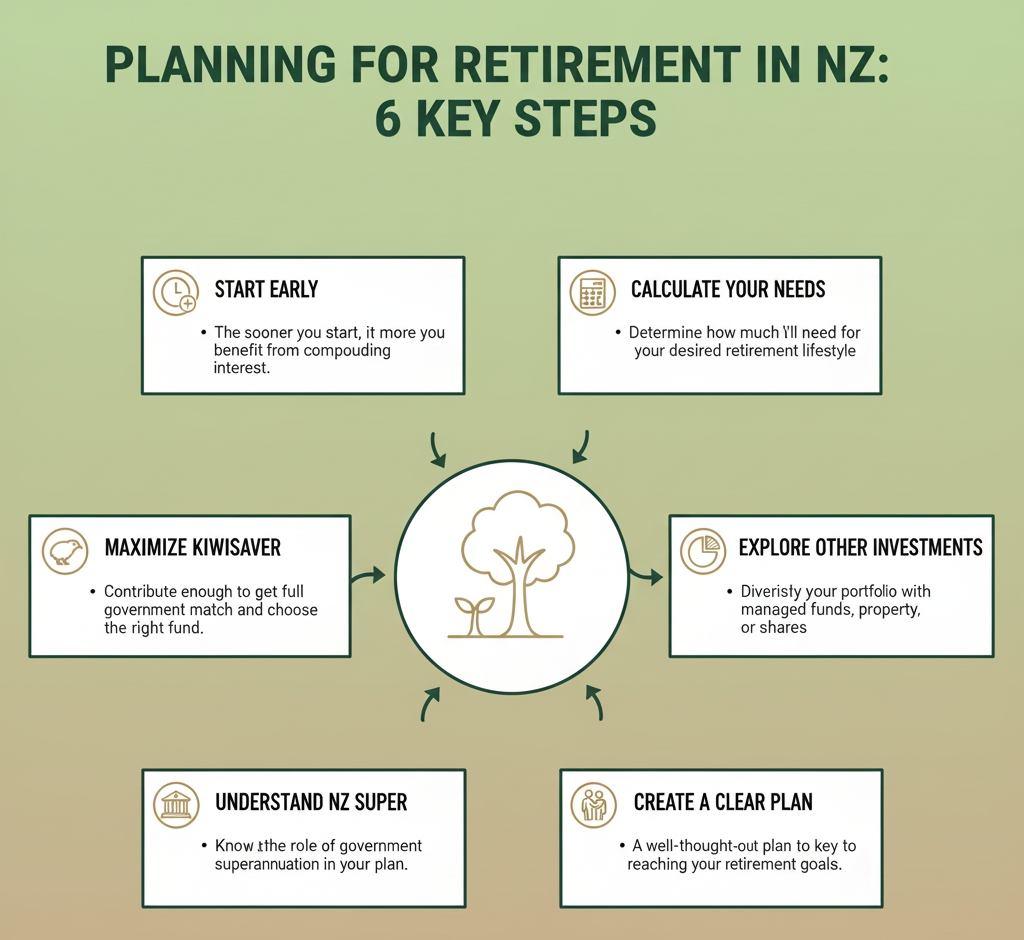

New Zealand’s retirement framework is relatively simple compared with many countries. There is a universal public pension, voluntary workplace saving through KiwiSaver, and a wide range of private investment options. There is no compulsory earnings-related pension beyond KiwiSaver contributions, and no requirement to convert savings into a guaranteed income stream at retirement.

As a result, retirement income for most people comes from a mix of:

- NZ Superannuation, providing a baseline payment from age 65

- Personal savings and investments, including KiwiSaver and non-KiwiSaver assets

- Housing outcomes, particularly whether accommodation is owned mortgage-free

- Ongoing paid work, often part-time or seasonal in the early retirement years

How these elements combine varies widely. Two households with similar lifetime earnings can reach retirement with very different levels of financial comfort depending on debt, health, family responsibilities, and market timing.

When people usually engage with retirement planning

Although early saving is often promoted as critical, many New Zealanders begin actively thinking about retirement later than expected.

Early working years

In people’s 20s and early 30s, retirement saving is often passive. KiwiSaver contributions are typically made through default settings, with limited engagement beyond enrolment. Income is usually lower, and saving for a first home deposit takes priority. Travel, study, career changes, and periods overseas commonly interrupt contribution patterns.

Time is an advantage at this stage, but consistency is often limited.

Mid-career years

For many households, retirement planning becomes more concrete during their 40s. Earnings are generally higher, mortgages are established, and KiwiSaver balances begin to feel material. This is also when financial pressure tends to peak, with education costs, business risk, and care for ageing parents becoming more visible.

Savings rates may increase in this phase, but they can also fluctuate due to redundancy, self-employment, or economic slowdowns.

Later working years

From the mid-50s onward, attention often shifts from growth toward stability. Time horizons shorten, tolerance for volatility may change, and planning focuses more on how income might be drawn rather than accumulated. Some people continue full-time work beyond 65, while others reduce hours earlier due to health or lifestyle considerations.

Across all age groups, the most common pattern is not steady optimisation, but periodic adjustment as circumstances change.

Estimating retirement income needs

A common question is how much income is required to retire comfortably in New Zealand. There is no single figure that applies universally, but reference points help frame expectations.

Income replacement benchmarks

A commonly used guideline suggests that retirees may require around 70–80 percent of their pre-retirement income to maintain a similar standard of living. This assumes that some costs fall away, such as commuting and work-related expenses, while others increase, including healthcare, insurance, and leisure spending.

In practice, this benchmark works best as a broad indicator rather than a target.

Indicative weekly retirement costs in New Zealand

| Household type | Location | Lifestyle description | Approx. weekly spend |

|---|---|---|---|

| Single | Main centre | No-frills (essentials, limited discretionary spending) | ~$900 |

| Single | Main centre | Choices (travel, dining, hobbies included) | ~$1,350 |

| Couple | Main centre | No-frills | ~$1,050 |

| Couple | Main centre | Choices | ~$2,000 |

These figures are drawn from the Retirement Expenditure Guidelines developed by Massey University and are intended as broad indicators only. Actual costs vary significantly depending on housing status, health, and location, and they tend to change over time rather than remaining fixed.

Housing, in particular, has an outsized impact. Mortgage-free homeowners generally face materially lower weekly costs than renters with similar savings.

KiwiSaver as a retirement foundation

For many New Zealanders, KiwiSaver forms the core of retirement savings, though balances vary widely.

Contributions and participation

KiwiSaver operates on a defined-contribution basis. Contributions usually come from wages or salaries, supplemented by employer contributions and the annual government contribution, subject to eligibility thresholds.

While the government contribution can meaningfully lift returns over long periods, its impact depends on consistent participation. Periods of self-employment, caregiving, or time spent overseas often reduce cumulative balances.

Fund selection and risk

KiwiSaver funds range from conservative to growth-oriented. Growth funds experience greater volatility but have historically delivered higher long-term returns, while conservative funds prioritise capital stability.

In practice, many members remain in default or mismatched funds for long periods. Changes are often triggered by market downturns or approaching retirement rather than by long-term planning.

Fees over time

Fees differ across providers and can affect outcomes over decades. While annual differences may appear small, their cumulative impact becomes more noticeable over long timeframes.

KiwiSaver is often described as simple, but real-world outcomes depend on contribution continuity, fund choice, and market conditions.

Assets beyond KiwiSaver

KiwiSaver alone is unlikely to support a higher-spending retirement for most households. As a result, many people build additional assets over time.

Managed funds and PIE investments

Managed funds outside KiwiSaver offer diversification and flexibility, with funds accessible when needed. Portfolio Investment Entities (PIEs) may provide tax efficiency depending on income levels. These investments are commonly used for medium- to long-term savings alongside KiwiSaver.

Direct share investments

Some individuals invest directly in shares, either in New Zealand markets or offshore. Outcomes vary widely depending on concentration, timing, and market conditions. This approach usually requires greater engagement and tolerance for volatility.

Property

Residential property plays a significant role in many New Zealand retirement outcomes. Mortgage-free ownership substantially reduces ongoing living costs, while investment properties may provide rental income or capital to draw on later.

However, property also concentrates risk, ties up capital, and depends on regulation, maintenance, and market conditions. Results differ markedly between households.

Cash and term deposits

Cash holdings and term deposits are commonly used for stability, particularly in later years. While they provide certainty, returns may struggle to keep pace with inflation over long periods.

When considering retirement spending, understanding how everyday costs are affected by tax can also be relevant. BusinessKiwi’s GST calculator can help illustrate how consumption taxes influence real-world expenses, particularly for households budgeting on fixed incomes.

NZ Superannuation and its limits

NZ Superannuation provides a baseline income from age 65 for eligible residents. It is not means-tested and is adjusted annually.

NZ Super is designed to cover basic living costs rather than discretionary spending. On its own, it generally aligns more closely with a no-frills lifestyle, particularly for renters or those with ongoing housing costs.

While the eligibility age is currently 65, long-term affordability remains a recurring public policy discussion. Any future changes would likely be phased in, but uncertainty remains part of long-term retirement planning. For this reason, NZ Super is commonly treated as a supplement rather than a sole income source.

Official, up-to-date information on eligibility and payment rates is available through New Zealand government retirement and superannuation resources.

Housing as a defining factor

Housing outcomes are one of the strongest predictors of retirement comfort in New Zealand. Mortgage-free homeowners generally experience much lower weekly expenses, giving NZ Super and modest savings greater purchasing power. Renters face ongoing exposure to market rents and less certainty around long-term costs.

Some households adjust housing in retirement by downsizing, relocating regionally, or releasing equity. These decisions are often shaped by health, family proximity, and lifestyle preferences rather than purely financial considerations.

Risks and uncertainty over time

Retirement planning rarely unfolds exactly as expected. Common challenges include:

- Market downturns close to retirement reducing portfolio values

- Longer-than-anticipated lifespans stretching savings

- Health events increasing costs or limiting earning capacity

- Inflation eroding fixed-income purchasing power

- Ongoing family financial support

In practice, flexibility and adaptability often matter as much as projections.

Retirement as a gradual transition

For many New Zealanders, retirement is not a sharp endpoint. Part-time employment, consulting, seasonal work, or business involvement often continue for several years. These income streams can ease the transition and reduce pressure on accumulated savings.

Rather than a single retirement date, the shift typically occurs gradually, shaped by opportunity, health, and personal choice.

Bringing it together

Retirement planning in New Zealand is shaped less by perfect strategy and more by cumulative, sometimes uneven decisions over time. KiwiSaver provides a useful foundation, NZ Super offers a safety net, and housing outcomes frequently determine overall comfort. Beyond that, results depend on market cycles, health, and policy settings that evolve over decades.

Understanding these dynamics helps frame expectations realistically. Retirement rarely looks exactly as projected, but for many households, adaptability and a mix of income sources matter more than precision.