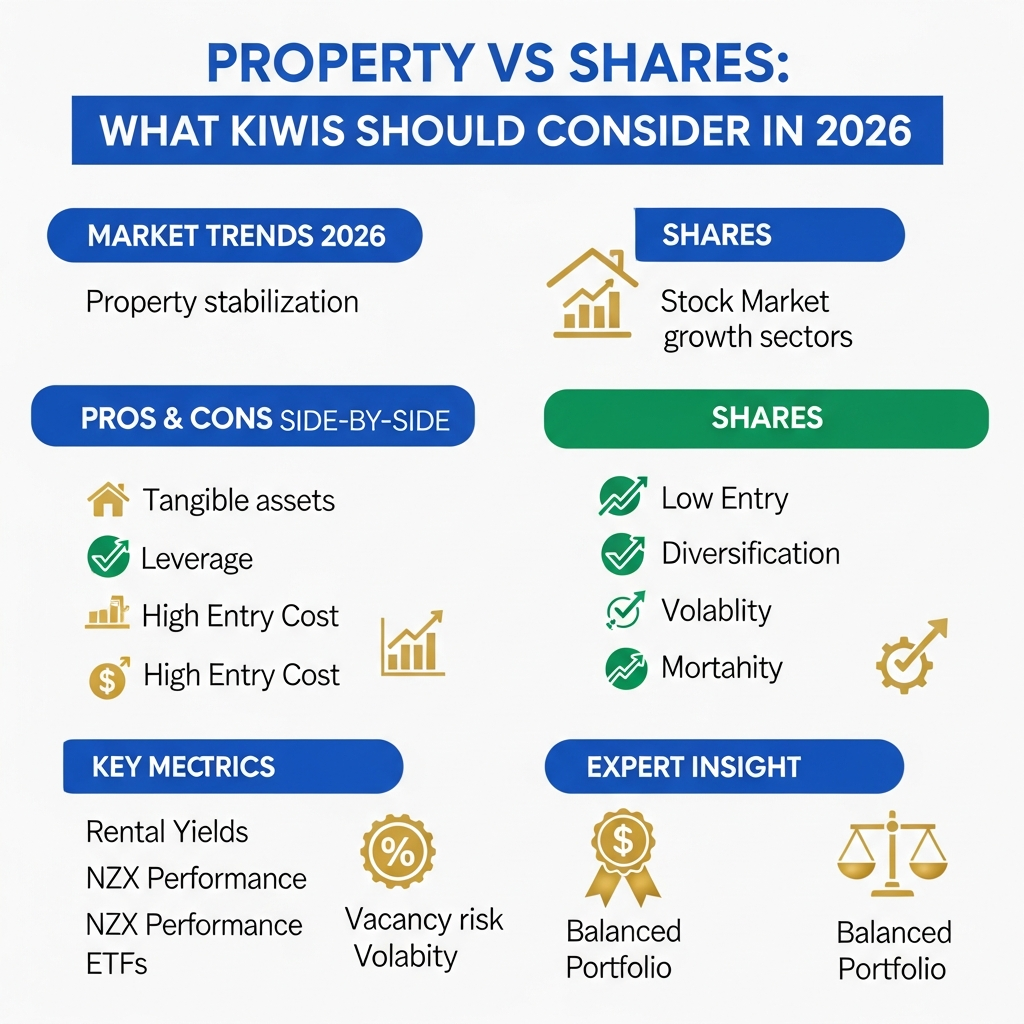

Property vs shares: What New Zealanders should consider in 2026

New Zealanders have been arguing about the best way to get rich for generations. Owning a piece of land is a common Kiwi dream, which makes property a popular investment. The stock market is also an interesting option because it is easy to get into and has a lot of potential. As we look ahead to 2026, we still don’t know if property is the best investment or if stocks are a better way to grow your money.

It’s not easy to choose between buying property and investing in stocks. Both have the potential to make a lot of money, but they also come with their own set of risks and duties. This guide will give you a fair comparison of investing in property versus shares in New Zealand in 2026. It will look at market trends, the pros and cons of each option, and expert opinions to help you make a better choice for your financial future.

The Real Estate Market in New Zealand in 2026

Property has been a key part of making money in New Zealand for a long time. But is property still a good investment in New Zealand as we get closer to 2026? Interest rates, government rules, and population growth all have an effect on the market, which is always changing.

Trends in Real Estate to Watch

There are a number of things that could change the property market in the future. After a time of instability, economists think that house prices may stabilize or rise slightly. Will the price of houses in New Zealand go up in 2026? No one has a crystal ball, but things like the ongoing housing shortage and high levels of immigration suggest that demand will stay high in major cities.

But investors should be aware of possible problems that could come up. Changes to interest rates by the Reserve Bank of New Zealand will have a direct effect on how much people can afford to borrow and how much they can afford to pay for a mortgage. Government rules about landlords’ duties, tenant rights, and taxes, like the bright-line property rule, will also keep affecting returns.

Another important part is rental yields. Investors should look into the 2% rule for property, which says that for an investment to be profitable, the monthly rent should be at least 2% of the purchase price. Getting this done is hard in many parts of New Zealand, which makes cash flow a major problem for property investors.

The Stock Market in 2026

Buying shares is a different way to get rich. Instead of owning a physical asset, you own a piece of a company (or multiple companies through a fund). The New Zealand stock market (NZX) lets you buy shares in companies based in New Zealand, while global markets offer endless chances.

Trends and chances in the stock market

The stock market’s performance in 2026 will depend on the state of the economy in both the US and the rest of the world. Technology, renewable energy, and healthcare are some of the areas that are likely to keep growing. If you’re looking for the best ETF to invest in NZ, diversified funds that track the NZX 50 or global indices like the S&P 500 are still popular because they are easy to understand and give you a broad view of the market.

Many stock investors like dividend yields because they give them a steady stream of income. Companies that have a history of paying dividends on time can be a key part of a long-term investment plan.

It’s also important to know how taxes will affect you. Investing in stocks in New Zealand can be hard to understand when it comes to taxes, especially when the investments are made from abroad. For instance, it’s important to know how the Foreign Investment Fund (FIF) rules apply to Australian shares and other foreign investments in New Zealand so you don’t get any surprise tax bills.

A Head-to-Head Comparison: What Are the Good and Bad Points?

It’s helpful to compare property and shares directly to see which one you should buy.

Property Investment

Pros:

- Tangible Asset: Many people feel safer knowing that they can see and touch their investment.

- Leverage: You can use a bank loan to buy something of great value, which can increase your potential returns. You can also grow your portfolio over time by learning how to borrow against equity.

- Control: You have full control over the asset, which means you can make changes to it to make it worth more.

Cons:

- High Entry Cost: A large deposit is needed, which makes it hard for many people to get in.

- Illiquid: It can take months to sell a property, which makes it hard to get your money quickly.

- High Maintenance: Ongoing costs like property management, insurance, repairs, and rates can cut into profits.

Share Investment

Pros:

- Low Entry Cost: You can invest with as little as a few dollars.

- Liquidity: You can buy and sell shares quickly, usually within a few business days.

- Diversification: You can lower your risk by spreading your money across many companies, industries, and countries.

Cons:

- Volatility: The market can be hard to predict, and in the short term, share prices can change a lot.

- Less Control: You don’t have much say in what the company does as a shareholder.

- Intangible: Some investors may feel less safe without a physical asset.

Looking at and lowering your risks

There is always risk with an investment. When you own property, the biggest risks are the market going down, interest rates going up, long vacancies, or repairs that cost more than you expected. You can lessen these risks by doing thorough due diligence, keeping a cash buffer for emergencies, and having enough insurance.

The main risk for stocks is that the market changes a lot. If the market crashes, your portfolio could lose a lot of value. The best way to lessen this is to diversify. If one company or sector does poorly, you won’t lose as much money if you don’t put all your eggs in one basket.

What the Experts Say

A lot of the time, financial advisors will tell you that the “property vs. shares” debate isn’t about which one is better for everyone, but which one is better for you. A Kiwi economist said recently, “In 2026, the smart investor won’t be asking whether to choose property or shares, but how to create a balanced portfolio that might include “Diversification remains the most effective strategy for long-term wealth creation.”

Another advisor stressed how important it is to think long-term: “Having a ‘get rich quick’ mindset is dangerous, whether you’re investing in a rental property or an ETF. “Investing well takes decades, not months.”

Examples of real-life Kiwis

For example, Sarah is a teacher in Auckland. In 2018, she used her savings to put down a deposit on a small two-bedroom unit. Five years later, she was able to borrow against her equity to invest in a diverse share portfolio, which gave her a second source of income. This was possible because of rental income and capital gains.

Tom is a software developer in Wellington, New Zealand. He began putting money into a cheap global ETF when he was in his early twenties. He has built up a large portfolio by adding to his investments every month, without having to deal with the headaches of managing property. He likes how easy and liquid shares are.

What Path Should You Take?

In the end, whether or not you should invest in property or stocks depends on your own situation.

- Goals for Money: Do you want to grow your capital over time, get a steady income, or both?

- Risk Tolerance: How okay are you with the idea that your investment might lose value? Are you more worried about the stock market going up and down or the housing market crashing?

- Time Horizon: Are you putting money away for retirement in 30 years, or do you need to get to it in the next five?

- Personal Involvement: Do you want to invest in something that you can touch, like real estate, or something that you don’t have to do anything with, like an index fund?

Answering these questions will help you figure out if property, shares, or a mix of the two is the best choice for your financial journey.