Evaluating Credit Cards and Personal Loans in New Zealand: How the Trade-Offs Usually Work

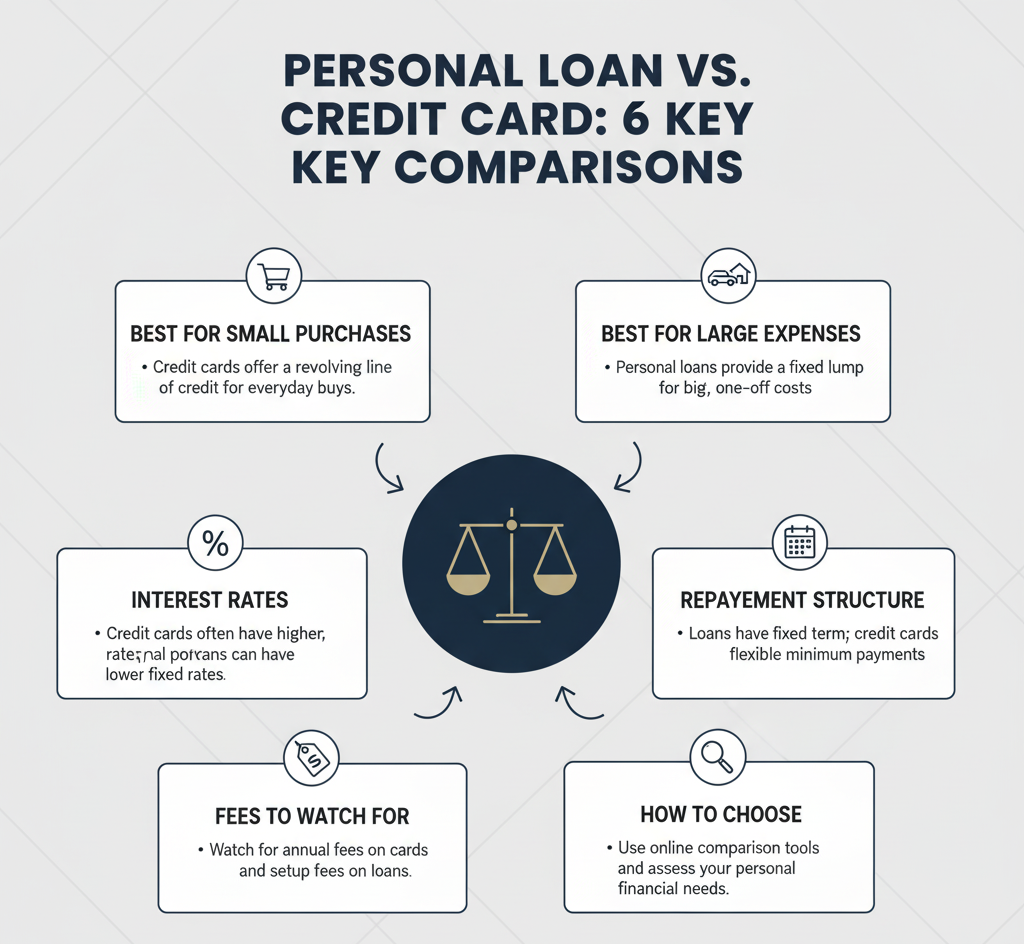

In New Zealand, credit cards and personal loans are often presented as interchangeable ways to borrow. In practice, they behave very differently once interest, repayment patterns, and real-world habits are taken into account. The choice is less about which product is “better” and more about how debt is likely to sit alongside income, spending, and financial pressure over time.

This article looks at how credit cards and personal loans typically function in the New Zealand market, focusing on where costs accumulate, where flexibility helps or harms, and why outcomes often diverge from initial expectations. The aim is not to recommend products, but to explain the trade-offs that tend to matter once borrowing moves beyond theory.

The core difference: open-ended debt versus defined repayment

The most important distinction between a credit card and a personal loan is not the interest rate, but the structure.

A credit card is open-ended. The balance rises and falls with spending and repayments, and there is no fixed end date as long as minimum payments are met. This flexibility is convenient, but it also allows debt to persist indefinitely.

A personal loan is closed-ended. A fixed amount is borrowed upfront, repayments are scheduled over a defined term, and the debt ends when the final payment is made. The structure forces progress, regardless of spending behaviour.

In practice, this structural difference often matters more than headline pricing.

How credit cards are actually used in New Zealand

Credit cards are deeply embedded in everyday spending. They are commonly used for groceries, fuel, online purchases, travel bookings, and short-term cash-flow gaps. While many cards are marketed around rewards or convenience, their long-term cost depends almost entirely on repayment behaviour.

Main credit card categories

Most New Zealand credit cards fall into three broad types:

- Low-interest cards

Designed for people who expect to carry balances. Interest rates are lower than standard cards, but annual fees may still apply. - Rewards cards

Offer cashback, points, or air miles. These cards typically carry higher interest rates and higher annual fees. Their value depends on whether balances are cleared regularly and whether rewards outweigh fixed costs. - Balance transfer cards

Used primarily to manage existing debt. Promotional interest rates are temporary, and costs can rise sharply once the introductory period ends.

Where credit card costs quietly accumulate

Credit card pricing is often underestimated because costs build gradually.

- Compounding interest

Interest is usually calculated daily. Even moderate balances can become expensive if they persist for long periods. - Minimum repayments

Minimum payments are designed to keep accounts active, not to eliminate debt quickly. Paying only the minimum often results in long repayment timelines. - Behavioural drift

Because the credit limit refreshes as repayments are made, spending can resume before the balance is meaningfully reduced. - Fees as fixed drag

Annual fees apply regardless of usage, which can erode the value of rewards or low headline rates over time.

For many households, credit card debt does not feel urgent until it has already become entrenched.

Personal loans: structure over flexibility

Personal loans are typically used for larger, defined expenses such as vehicles, home improvements, or consolidating multiple debts into one repayment.

Secured and unsecured loans

- Secured personal loans

Backed by an asset, commonly a vehicle. Interest rates are usually lower, but the asset may be at risk if repayments are missed. - Unsecured personal loans

Not tied to an asset. Approval depends on income and credit history, and interest rates are higher to reflect increased lender risk.

How personal loan costs behave over time

Personal loans tend to feel clearer upfront, but trade-offs still exist.

- Fixed repayments

Most personal loans have fixed repayment schedules, which makes budgeting easier but reduces flexibility. - Interest certainty

Fixed rates provide predictability, while variable rates introduce exposure to market changes. - Term length effects

Longer terms reduce repayment pressure but increase total interest. Shorter terms do the opposite.

The key difference is that debt reduction is automatic as long as repayments continue.

Credit cards vs personal loans: practical comparison

| Feature | Credit cards | Personal loans |

|---|---|---|

| Debt structure | Open-ended | Fixed term |

| Repayment certainty | Low | High |

| Interest visibility | Gradual, compounding | Known upfront |

| Behavioural risk | High | Lower |

| Flexibility | High | Limited |

| Debt persistence risk | Common | Lower |

This comparison highlights why outcomes often differ even when interest rates appear similar.

Real-world decision patterns

In practice, credit cards tend to work best when:

- Spending is short-term

- Balances are cleared regularly

- Income is stable enough to absorb fluctuations

Personal loans tend to work better when:

- The expense is one-off and planned

- A clear repayment end date matters

- Cash-flow predictability is important

Problems often arise when flexible credit is used for long-term borrowing, or when fixed repayments are taken on without sufficient income resilience.

The role of everyday costs and tax pressure

Borrowing decisions do not exist in isolation. Repayment capacity is influenced by everyday expenses, many of which include consumption tax.

Understanding how much GST is embedded in regular spending can help explain why budgets feel tighter than expected. BusinessKiwi’s GST calculator can be useful for illustrating how tax affects real cash-flow, particularly for households or sole traders balancing repayments alongside operating costs.

Eligibility and access constraints in New Zealand

Access to credit is shaped by:

- Income regularity

- Employment stability

- Credit history

- Residency and visa status

People on temporary visas, including work visas, often face stricter lending conditions or lower limits. Personal loans may require longer visa durations, while credit cards may be issued with conservative limits. These constraints can narrow options regardless of preference.

Consumer protections and neutral guidance

New Zealand’s consumer credit environment is governed by responsible lending rules. Neutral information about borrowing rights and lender obligations is available through MoneyTalks, a government-supported financial capability service.

These resources explain borrower protections without promoting products or strategies.

Why outcomes differ from expectations

The gap between expected and actual borrowing outcomes is often driven by:

- Changes in income

- Extended use beyond the original purpose

- Underestimating how long balances persist

- Over-reliance on minimum repayments

Understanding these dynamics matters more than choosing an ideal product at the outset.

Pulling the comparison together

Credit cards and personal loans both have a place in the New Zealand credit landscape, but they solve different problems and create different risks. Credit cards offer flexibility at the cost of behavioural exposure, while personal loans trade flexibility for structure and certainty.

In practice, long-term outcomes depend less on product features and more on how debt interacts with income stability, spending habits, and the ability to adapt when circumstances change. Recognising those trade-offs is usually more valuable than finding the lowest advertised rate.