How to value a business nz: Putting a Price on a Business in New Zealand

Knowing the true value of your business is essential when making major financial and strategic decisions. In New Zealand, business valuation is most commonly required when an owner is preparing to sell, bring in investors, refinance, restructure ownership, or plan succession. In each case, an accurate valuation provides clarity, credibility, and leverage.

Unlike publicly listed companies, most New Zealand businesses are privately owned small and medium-sized enterprises (SMEs). These businesses do not have a public market price. Instead, value is determined through a structured assessment of financial performance, risk, industry norms, and market demand. The objective is not to produce a theoretical figure, but to arrive at a realistic and defensible value that reflects what a knowledgeable buyer would reasonably pay under normal market conditions.

This guide explains how business valuation is typically carried out in New Zealand, the methods professionals use, the local factors that influence value, and realistic examples by industry. It is written for business owners who want a practical understanding of how pricing decisions are actually made in the market.

What Business Valuation Means in the New Zealand Context

Business valuation is the process of estimating the economic value of a business at a specific point in time. In New Zealand, valuations are shaped by several structural realities:

- The economy is dominated by owner-operated SMEs

- Cash flow sustainability is prioritised over scale

- Leasing is more common than property ownership

- Buyers focus heavily on risk, transferability, and continuity

Because of this, valuations in New Zealand emphasise maintainable earnings, owner dependence, and operational stability, rather than aggressive growth forecasts.

A valuation reflects the price a willing buyer and a willing seller might reasonably agree upon, assuming both parties are informed and under no pressure to transact.

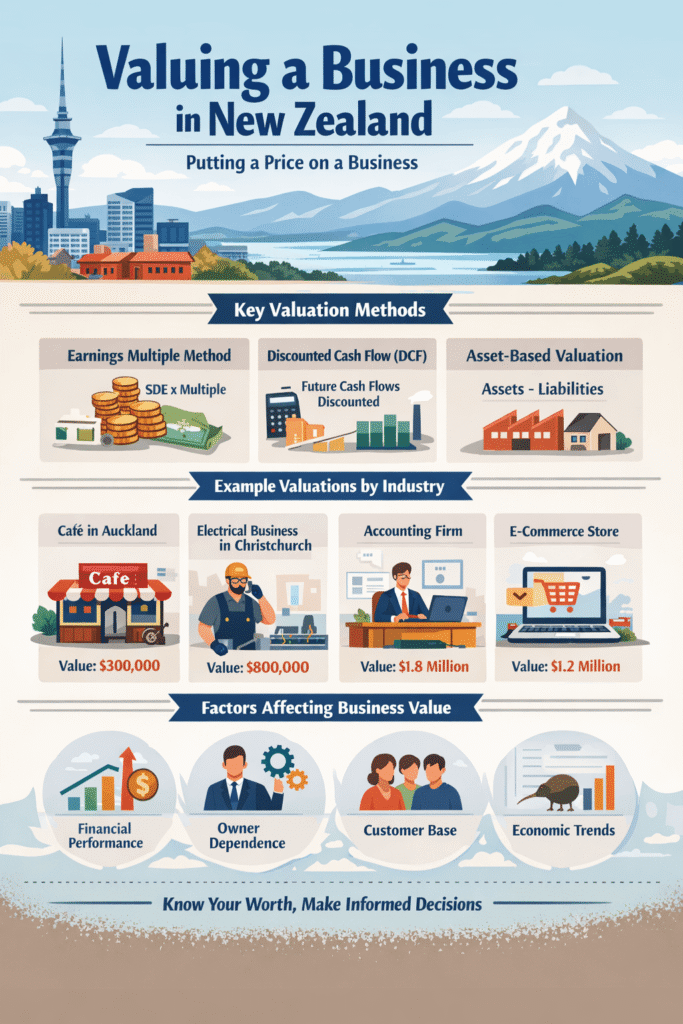

Core Methods Used to Value a Business in New Zealand

Professional valuers rarely rely on a single method. Instead, they apply one primary approach supported by secondary checks to ensure the outcome aligns with real market behavior.

1. Earnings Multiple (Capitalisation of Earnings) Method

This is the most commonly used valuation method for profitable New Zealand SMEs.

How the method works

The value of a business is calculated by multiplying maintainable earnings by a market-appropriate multiple.

The earnings figure used is typically:

- Seller’s Discretionary Earnings (SDE) for owner-operated businesses, or

- EBIT (Earnings Before Interest and Tax) for businesses with management structures in place

SDE adjusts reported profit to reflect the true economic benefit available to a single owner by adding back:

- Owner salary

- Personal expenses paid through the business

- Non-recurring or one-off costs

- Depreciation and amortisation

Typical valuation multiples in New Zealand

While there is no fixed standard, common market ranges are:

- Owner-dependent businesses: 1.5× – 2.5× SDE

- Stable service businesses with systems: 2.5× – 3.5× SDE

- Well-managed businesses with growth potential: 3.5× – 5.0× EBIT

Multiples vary by industry, size, risk profile, customer concentration, and owner involvement.

2. Discounted Cash Flow (DCF) Method

The DCF method values a business based on its expected future cash flows, discounted to present value using a rate that reflects risk.

When DCF is used in New Zealand

DCF is most commonly applied to:

- Technology and SaaS businesses

- Export-focused companies

- High-growth or early-stage ventures

- Investment-driven valuations

DCF is sensitive to assumptions about growth rates and discount rates. For this reason, it is typically used alongside market-based methods rather than on its own for SME transactions.

3. Asset-Based Valuation Method

The asset-based approach calculates value as:

Total Assets – Total Liabilities

This method is most appropriate when:

- The business owns significant tangible assets

- Profitability is weak or inconsistent

- Liquidation or restructuring is relevant

For profitable service-based businesses, asset-based valuation usually provides a valuation floor, not the final price.

NZ Valuation Examples by Industry (Realistic Market Scenarios)

The following examples reflect how businesses are commonly valued in the New Zealand market. Figures are illustrative and based on typical market behaviour rather than theoretical models.

Hospitality – Independent Café (Auckland)

- Normalised SDE: NZD 140,000

- Owner works full-time in the business

- Lease with moderate renewal risk

Typical multiple: 2.0× – 2.3×

Estimated value: NZD 280,000 – 320,000

Hospitality businesses often attract lower multiples due to staffing volatility, lease exposure, and owner reliance.

Trade Services – Electrical Contracting Business (Christchurch)

- Normalised SDE: NZD 260,000

- Systems and trained staff in place

- Diverse residential and commercial client base

Typical multiple: 2.8× – 3.2×

Estimated value: NZD 730,000 – 830,000

Reduced owner dependence and steady demand support stronger valuations.

Professional Services – Accounting Practice (Regional New Zealand)

- EBIT: NZD 420,000

- Recurring compliance and advisory work

- Succession-ready structure

Typical multiple: 4.0× – 4.5×

Estimated value: NZD 1.68M – 1.89M

Predictable revenue and high client retention justify higher multiples.

E-commerce – Consumer Products (Nationwide)

- EBITDA: NZD 310,000

- Recognisable brand and repeat customers

- Marketing-driven growth model

Typical multiple: 3.5× – 4.5×

Estimated value: NZD 1.08M – 1.40M

Customer acquisition costs, supplier reliability, and margin stability heavily influence outcomes.

Asset-Heavy Construction Business (Waikato)

- Net tangible assets: NZD 1.2M

- Earnings fluctuate with project cycles

Valuation approach: Asset-based plus earnings overlay

Estimated value: NZD 1.15M – 1.30M

Asset value establishes the baseline, with goodwill assessed separately.

Comparison Table: Business Valuation by Industry in New Zealand

| Industry | Valuation Basis | Typical Multiple | Risk Level | Main Value Drivers |

|---|---|---|---|---|

| Hospitality | SDE | 1.5× – 2.5× | High | Lease terms, staffing stability, owner involvement |

| Trade Services | SDE | 2.5× – 3.5× | Medium | Recurring work, systems, customer diversity |

| Professional Services | EBIT | 3.5× – 5.0× | Low–Medium | Client retention, succession readiness |

| Retail | SDE | 2.0× – 3.0× | Medium–High | Margins, foot traffic, lease security |

| E-commerce | EBITDA | 3.0× – 4.5× | Medium | Brand strength, marketing efficiency |

Step-by-Step Business Valuation Process

- Clarify the purpose of the valuation

Sale preparation, refinancing, shareholder restructuring, or planning all require different levels of detail. - Collect at least three years of financial records

Profit and loss statements, balance sheets, cash flow statements, and tax returns are essential. - Normalise earnings accurately

Adjust for owner remuneration, personal expenses, and non-recurring items to reflect true operating performance. - Apply appropriate valuation methods

Use earnings multiples as the primary method and validate with asset-based or DCF analysis where relevant. - Adjust for qualitative risk factors

Owner dependence, customer concentration, lease terms, and industry conditions influence the final outcome.

The final valuation should balance numerical analysis with professional judgement.

Frequently Asked Questions

A business in New Zealand is typically valued by analysing maintainable earnings and applying an industry-appropriate multiple, then adjusting for risk factors such as owner dependence, customer concentration, and lease terms.

Most New Zealand SMEs are valued between 1.5× and 3.5× Seller’s Discretionary Earnings, while well-managed businesses may achieve up to 5× EBIT, depending on industry and risk.

Yes. Goodwill represents intangible value such as brand reputation, customer relationships, systems, and future earning potential, and is commonly included in NZ business valuations.

A professional valuation is not legally required, but it is strongly recommended to set a realistic asking price and support negotiations.